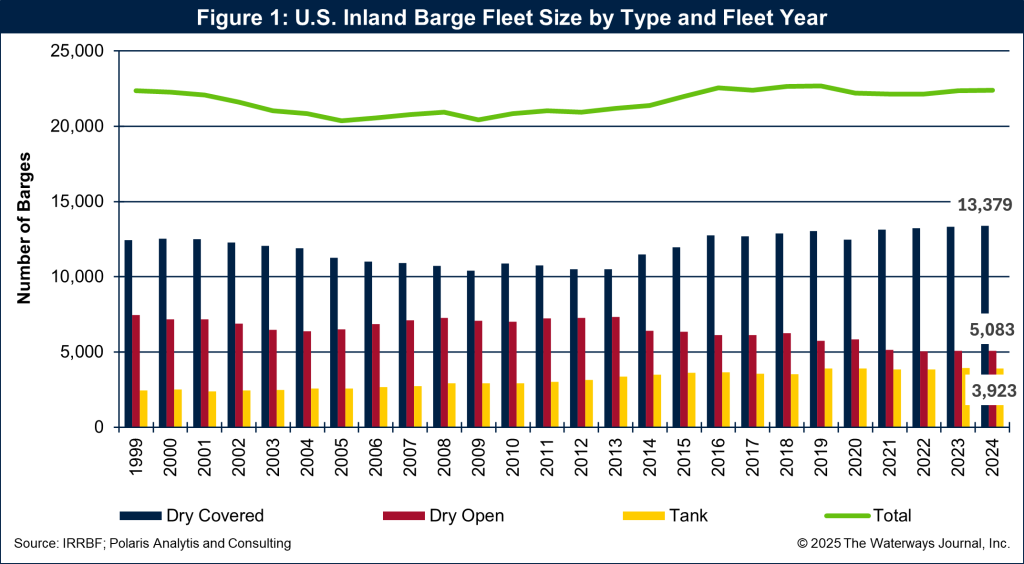

The number of barges being worked on the Mississippi River system, its connecting waterways and the Gulf Intracoastal Waterway during 2024 totaled 22,385, including dry covered, dry open and tank barges. The fleet increased by 29 barges, or by less than one tenth of 1 percent. On December 31, the dry covered fleet totaled a record 13,379 barges, an increase of 58 from 2023, while there were 5,083 dry opens in operation (a drop of 5) and 3,923 tank barges (a drop of 24).

The dry open fleet has rapidly declined in the past dozen years, dropping from 7,325 barges in 2013. It first dropped below 5,100 barges in 2021 and has been hovering at that level since. Dry open barges are mostly used to haul coal, which has seen its production and use cut by more than half over the same timeframe.

The number of barges by type used on the Mississippi River system is shown in Figure 1.

IRR Barge Fleet survey

The Waterways Journal is about to release the results of the annual IRR Barge Fleet survey. The survey strives to identify the line haul, commodity-carrying fleet of inland barges operating on the inland rivers by barge operator. The key data gathered is the number of barges in revenue service at the end of the calendar year by barge type and by year of construction. Operators were also asked how many barges were retired during the year, what is the value of a vintage aged, covered barge and what was the average number of trips per year, among other questions.

New Construction and Retirements Rebound In 2024

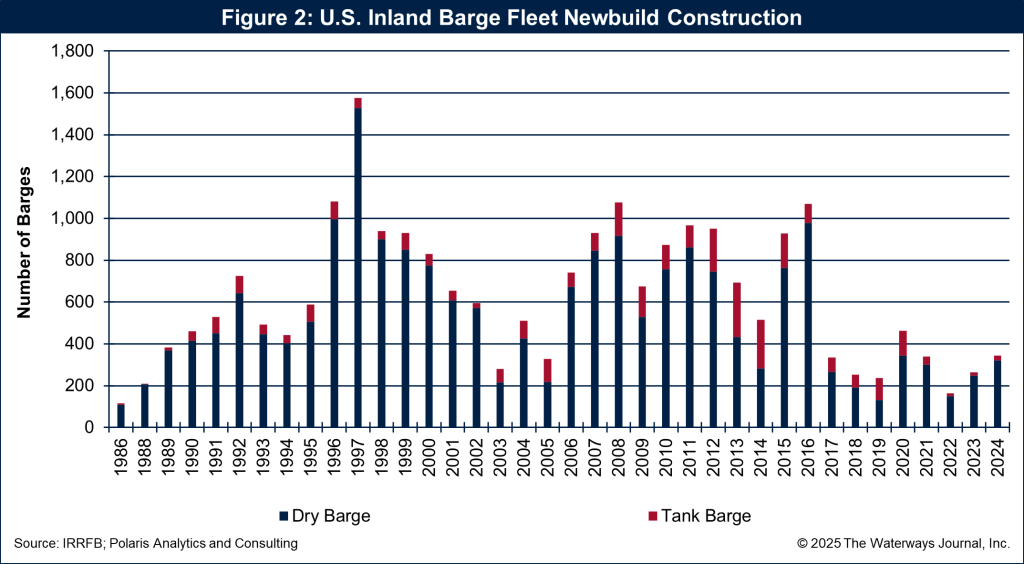

Based on survey results and market information, the industry, including 21 dry cargo and 21 tank cargo barge operators (which consist of about 650 owners of dry barges and 350 tank barge owners), added 344 new barges during 2024. This was the largest newbuild program since 2020, when 462 barges were added to the fleet. The newbuild program in 2022, with only 163 new barges, was the lowest level since 1986 when 115 were built. Despite a rebound in construction, the industry essentially remains below 400 new builds since 2017.

The number of dry barges built during 2024 totaled 322, while new tank barges totaled 22. The high cost of steel has been an impediment, increasing the price of a new barge to historical levels and putting a pause on newbuilds. Dry barges use approximately 340 short tons of steel, while a 10,000 barrel tank barge requires upwards of 425 tons. A 30,000 barrel tank barge requires around 900 tons of steel. As an example, in the survey, barge operators reported the value of a 10-year-old dry covered barge averaged $624,400 during 2024, a record level.

Furthermore, there remains essentially two builders constructing barges since Jeffboat exited the industry in 2018. Today, Arcosa and Heartland Fabrication are the two largest builders, with Arcosa delivering the highest share of newbuilds. Since Jeffboat closed, the newbuild capacity is not what it was when nearly 1,600 barges were delivered in 1997 and more than 1,000 barges were built in 2008 and 2016.

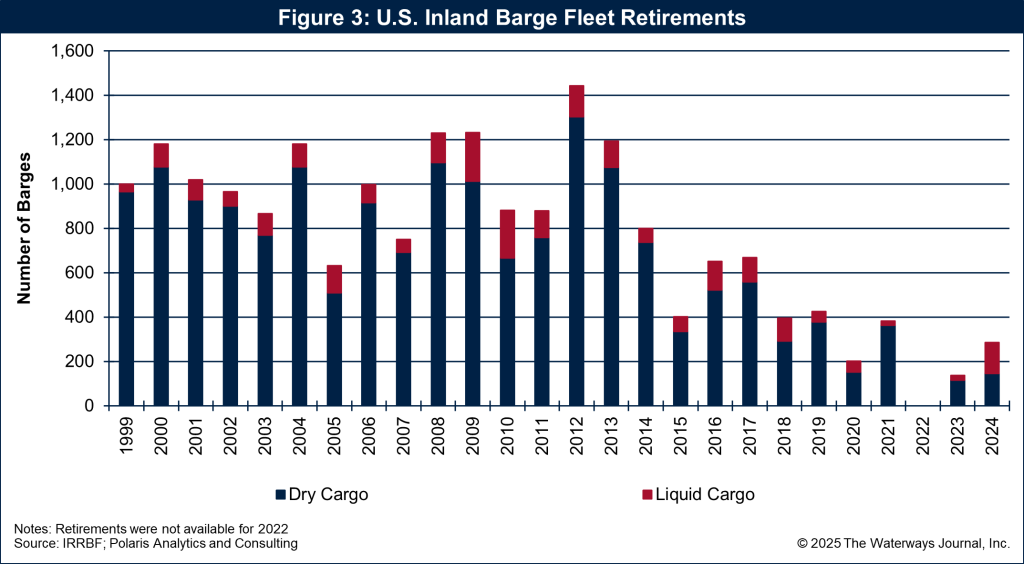

Retirements in 2024 totaled 286 barges, which is below the annual average of 369 since 2017 but more than the 137 retired in 2023. The number of dry barge retirements reported in 2024 totaled 147. Tank barge retirements totaled 139.

As with many years, the fleet size of the most immediate year (such as 2024) can and will be larger in the following year as late-delivered newbuilds enter the fleet.

The number of newbuild barges is shown in Figure 2 and retirements in Figure 3.

Dry Barge Fleet Aging While Tank Peaking

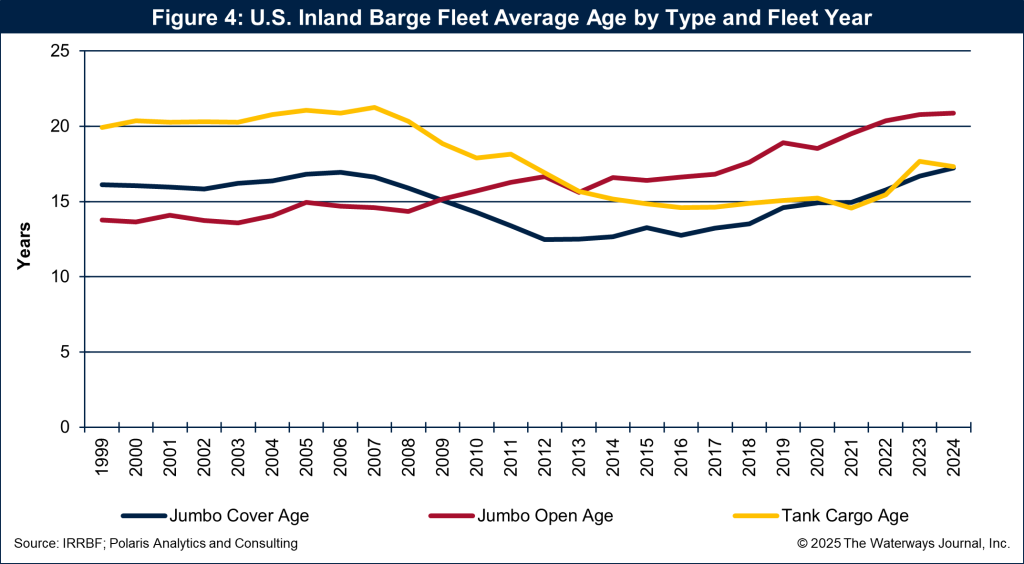

The age of a barge is reflective of the condition of the fleet. For example, if the fleet is getting younger, that means newer barges are entering service, older barges are being retired at an accelerated pace or a combination of both. The converse is true as well. If there are fewer newbuilds and not as many older barges are being retired, the average age increases. However, while fewer retirements help maintain fleet size, a moribund retirement schedule also contributes to an aging problem as older barges remain in operation longer.

Despite an increase in new construction, the inland barge fleet continues to age, posing long-term challenges for efficiency and maintenance costs. The dry cargo fleet’s average age climbed to 18.3 years in 2024, up from 14.3 years in 2017. Even though the tank barge fleet age may have peaked at 17.3 years in 2024, it is aging faster than the dry fleet, with a noticeable increase from the 15-year average maintained from 2015 to 2019. This aging trend reflects slower replacement rates and the durability of older barges, many of which remain in service due to economic pressures or limited newbuild capacity.

The average age of the inland barge fleet is shown in Figure 4.

Rapidly Developing Retirement Scenario?

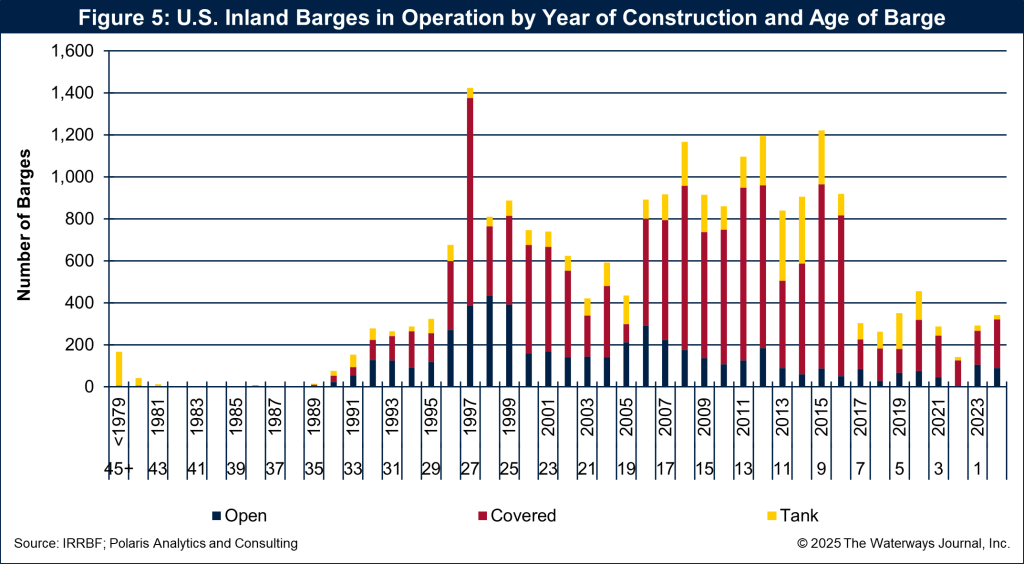

The number of barges in operation by year built is a fascinating study on life expectancy, and that would require more space than this column can supply. By looking at Figure 5 (the number of barges in operation by year built and age), the percentage of the fleet that is between 8 years old (built in 2016) and 28 years (built in 1996) is 82 percent of the 2024 fleet.

Nearly 40 percent of the 2024 fleet, or 8,577 barges, is equal to or older than 20 years. This is reduced a bit more when looking at the fleet that is 25 years or older, which represents 25 percent of the fleet, or 5,448 barges.

However the fleet is sliced and diced, there are many older barges that will soon need to be sliced and diced as retirements.

Retire, Replace, Resurge

The 2025 IRR Barge Fleet report underscores an industry at a crossroads. The uptick in new construction and modest fleet growth signal resilience and adaptation to cargo market demands. However, the aging fleet and below-average construction rates highlight the need for sustained investment in modernization to enhance efficiency and performance. Repeating what was said in this column last November, the industry needs to focus on the 3 Rs of the inland barge fleet: retire, replace and resurge. As operators and owners navigate economic uncertainties and regulatory pressures, the data in the IRR Barge Fleet report will be crucial for informed decision-making.

The IRR Barge Fleet is an indispensable resource for operators, owners, financers, suppliers and policymakers. The 2025 IRR Barge Fleet report is more than a snapshot. It’s a compass, guiding the industry through the currents of change. The report is available from The Waterways Journal.