The inland barge market likely finished 2024 on a high note with improved U.S. exports of grain, soybeans and products and coal, along with improved barge lockings as highlighted in the December 20 Horizons column.

With 2024 fading farther in the rearview mirror, what does 2025 have on the horizon? This column considers the key commodities that move on the inland rivers in relation to the inland barge fleet size.

The bottom line is this: 2025 is looking up.

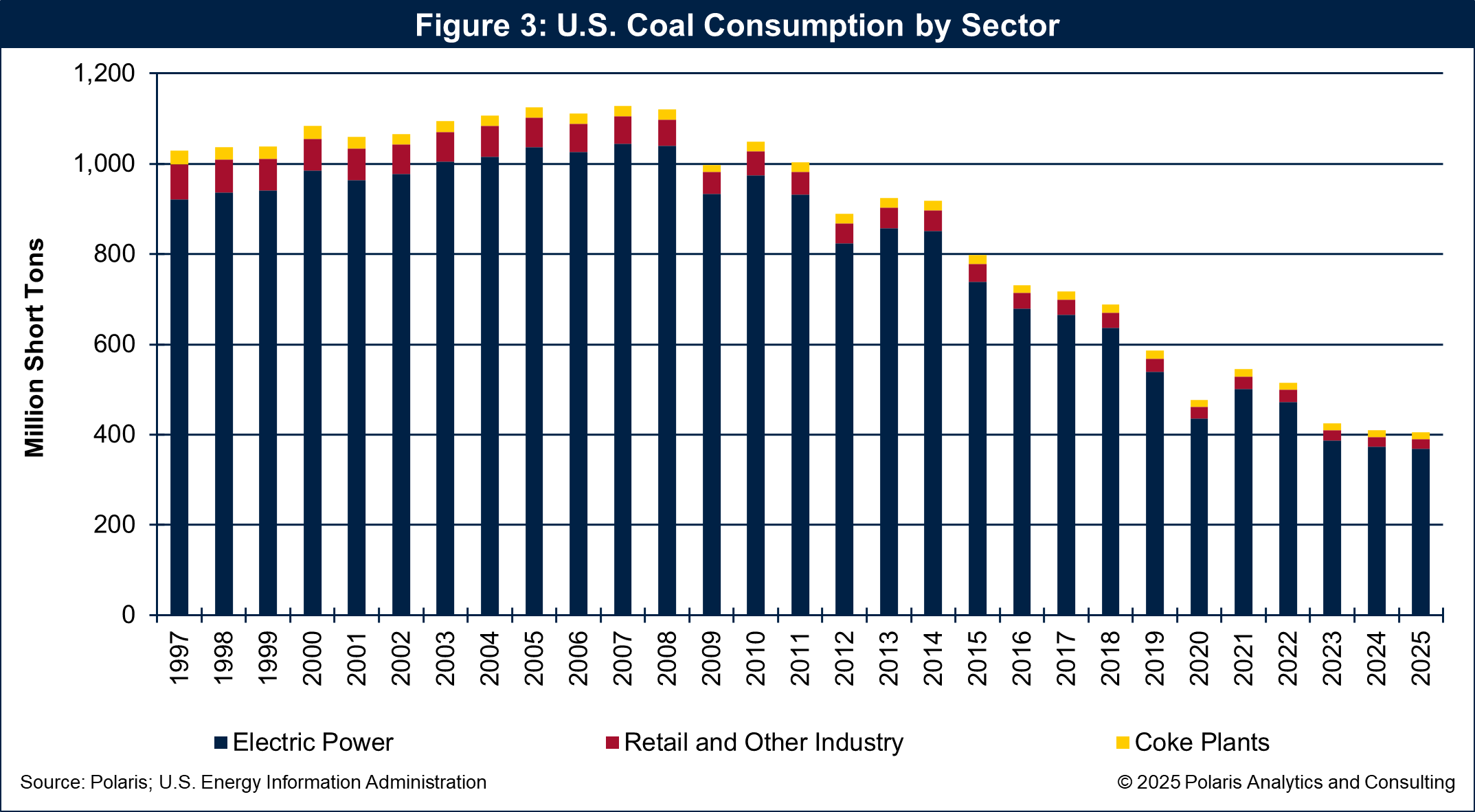

As a reminder, 70 percent of the internal barge tonnage moved on the inland rivers includes petroleum (e.g., gasoline, distillate fuel oil, residual fuel oil, naphtha and asphalt), farm products (e.g., corn, soybeans and wheat), coal, and soil, sand, rock and stone.

The annual volume moved by barge averaged 482.6 million short tons from 2018 through 2022 (the last year that data is available through the U.S. Army Corps of Engineers). Commodities moved by inland river barge are shown in Figure 1.

Ag Exports Forecast Higher

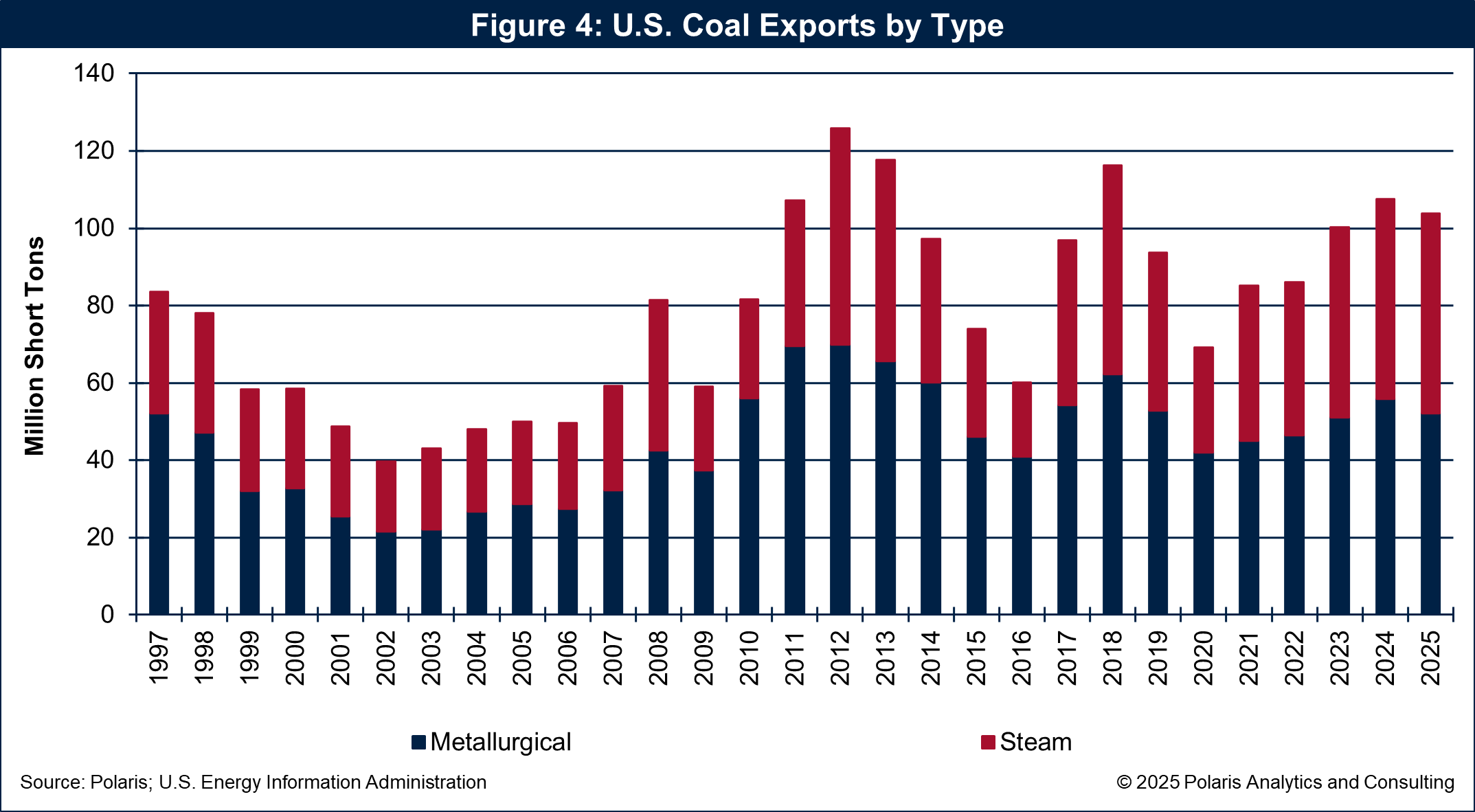

U.S. grain and soybean exports are forecast to total 140.8 million metric tons during the 2024-2025 crop marketing year that started September 1, increasing 8.5 percent or 11 million from the previous marketing year. If realized, total exports will be the fifth highest in U.S. history.

Corn exports are forecast to increase 6.9 percent or 4 million metric tons to 62.3 million during 2024-2025. Corn exports are expected to be the second highest in history, following the record set in 2020.

Exports of soybeans are forecast to increase 7.7 percent or 3.5 million metric tons during 2024-2025 to 49.7 million. Soybean exports have averaged 53.2 million metric tons in the previous five years.

Grain and soybean exports are shown in Figure 2.

The Center Gulf will benefit from the increase in exports considering that 50 percent to 60 percent of U.S. grain and soybean exports are moved through export elevators along the Mississippi River Ship Channel (MRSC). Of the volume exported through the MRSC, more than 95 percent arrives by barge.

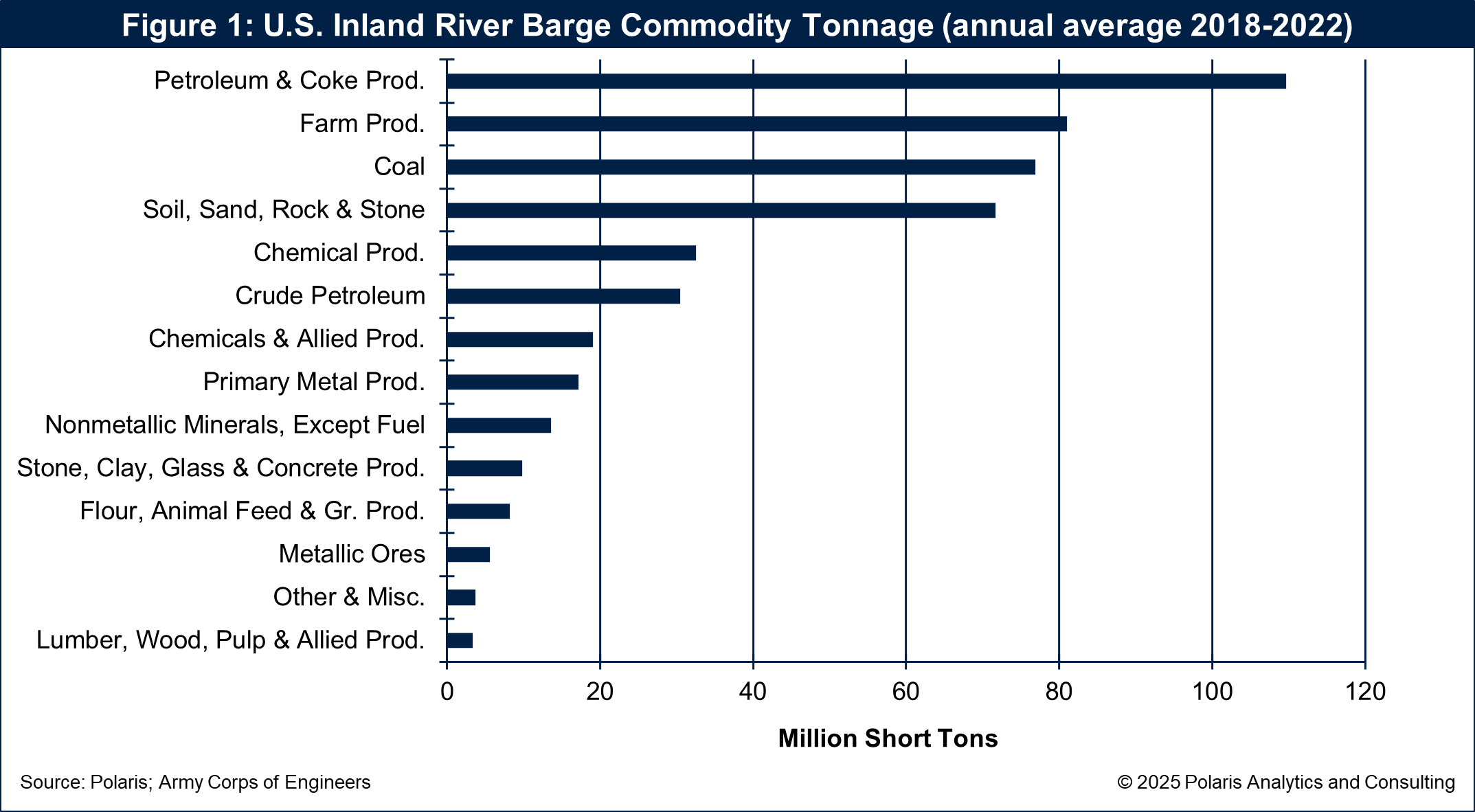

Coal Stabilizing

The worst of the decline in coal production and consumption appears to be finding a bottom. U.S. coal consumption is forecast to total 405.3 million short tons during 2025, which would be 1 percent or 4.1 million short tons lower than 2024. However, one decade ago, coal consumption was nearly double at about 800 million short tons. The annual rate of decline has slowed. For coal shippers and barge operators, this gives stability to movements. U.S. coal consumption is shown in Figure 3.

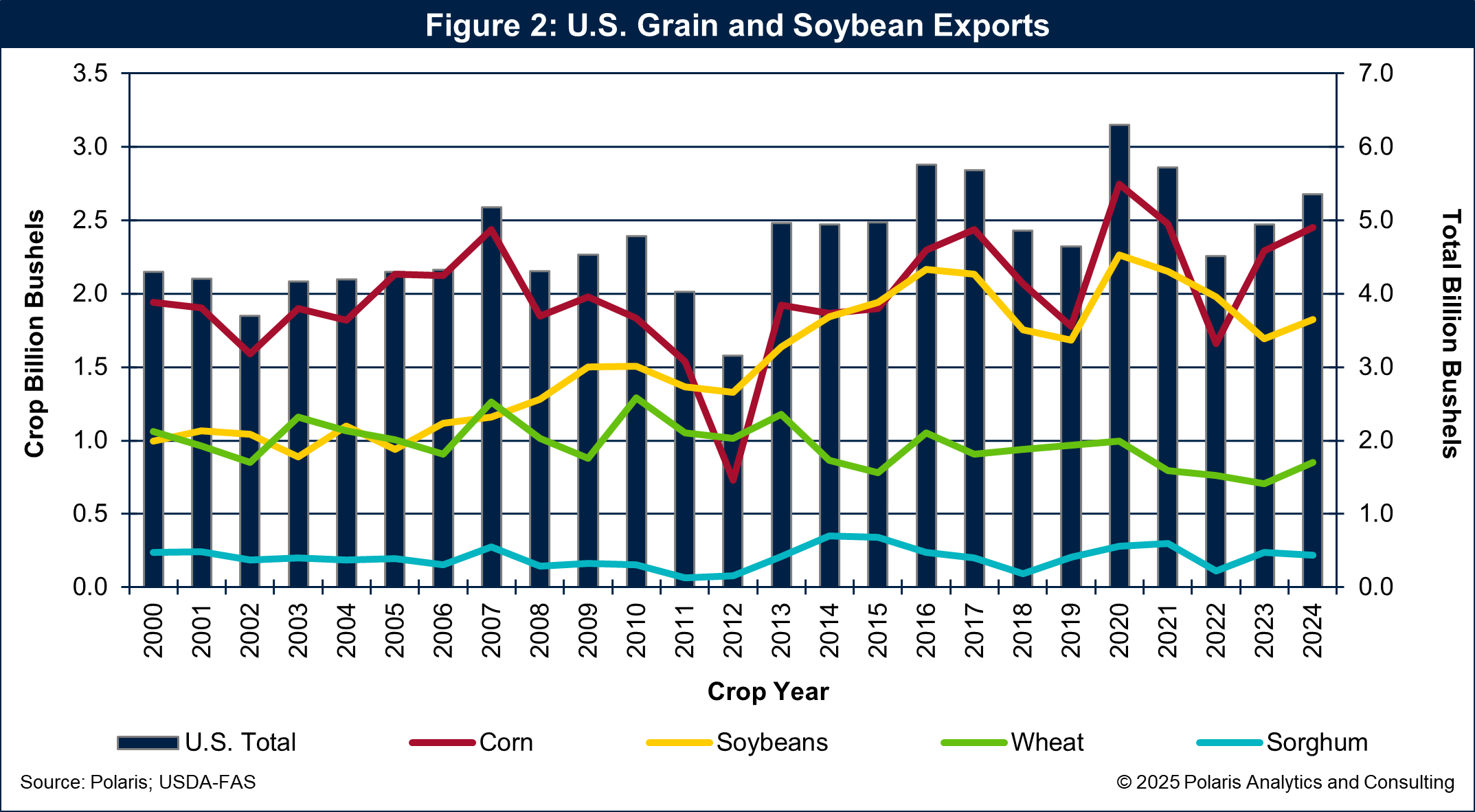

U.S. coal exports are estimated to have finished 2024 at 107.5 million short tons, 7.3 million higher than 2023 and the highest in six years. For 2025 coal exports are forecast to be down 3.3 percent or 3.6 million tons at 103.9 million. Despite the lower forecast, if realized this will be the seventh time in U.S. history that coal exports exceed 100 million short tons.

Coal exports are now a bright spot for U.S. coal production. During the early 2000s, coal exports represented about 5 percent of total coal production. Since 2010, though, that share increased to 12 percent in 2012, 15 percent in 2015 and is expected to be nearly 22 percent in 2025. For the barge market, positioning coal to export position is a long-haul move compared to domestic positioning.

Historically, metallurgical coal exports are the dominant type exported, with an average share of 58 percent to as high as 69 percent. Steam coal exports have never exceeded metallurgical volumes, but they have gained momentum, totaling nearly half of coal exports since 2023. Steam could come close to exceeding metallurgical volumes soon.

Coal exports by type are shown in Figure 4.

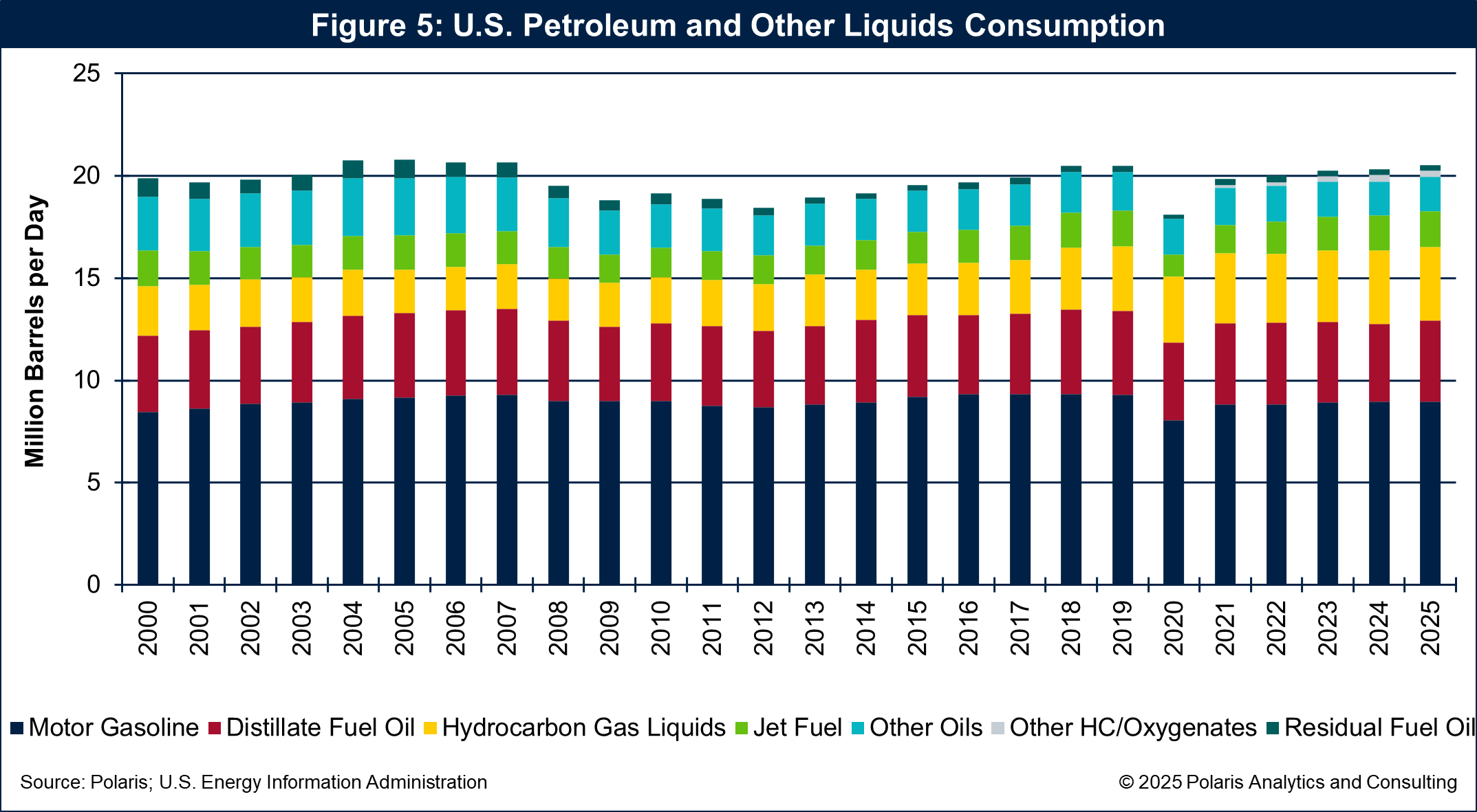

Petroleum, Other Liquids Reaching Pre-COVID Levels

U.S. consumption of petroleum and other liquids suffered greatly during the COVID-19 pandemic but are on track to regain levels seen prior to 2020. Consumption is forecast to total 20.54 million barrels per day in 2025, essentially overcoming the lost volume during COVID in 2020. Prior to COVID, the consumption of petroleum and other liquids increased an average of 1.5 percent per year from its historical low level in 2012 through 2019. These commodities, especially distillate fuel and motor gasoline, represent a substantial portion of tank barge volumes handled and will provide further support to the sector during 2025.

Strengthening Demand Supports Barge Fleet

With strengthening demand from grain and soybean exports, stabilizing coal consumption and rebounding petroleum product consumption, the inland river barge sector is poised for opportunity. At the end of 2023, the barge fleet totaled 22,356 pieces of equipment according to The Waterways Journal’s Inland River Record Barge Fleet Profile report.

During 2023, new builds totaled 265 while retirements totaled 137, making for a slight increase in the size of the fleet. However, the fleet is aging, as discussed in the November 22 Horizons column, “3 Rs For The Barge Industry: Retire, Replace, Resurge.” There is a need to not just retire and replace barges. Given strengthening demand prospectives, we need to add to the fleet.

Costs to build new barges remain stout as steel prices are not waning. Based on the the U.S. Bureau of Labor Statistics’ producer price index (PPI), fabricated steel plate prices continue to run higher. The December 2024 PPI for steel plate was 254.5, an increase of 13 percent from the previous year.

Scrap steel prices, on the other hand, display more volatility. The December 2024 PPI was 516.3, 15 percent lower than one year ago.

While the industry needs to retire and replace aging equipment, the scrap value of a barge is not offering much support, given the lower PPI for scrap steel, while the cost of new steel continues to run higher.

The inland river barge market is poised to propel higher on improving demand prospects. With a new administration entering the White House and taking charge of various agencies, the risk of trade tariffs has various industries on edge. However, the prospect of relaxed regulations to drill for oil, dig for coal, invest in manufacturing, improve corporate taxes, etc., offers opportunity over the horizon.