Tis the season of naughty and nice lists, but more so the hope and joy that live on through the miracle of Christmas. There has been much to consider for the naughty and nice lists this year. List items for the Mississippi River and Tributaries (MRT), including commodity exports, water levels of the Mississippi River, barge freight rates and lockings, are all highlighted in this column. For the MRT, Christmas came early with rebounding lockings and tonnage.

U.S. Grains, Soybeans and Coal Exports Rebound

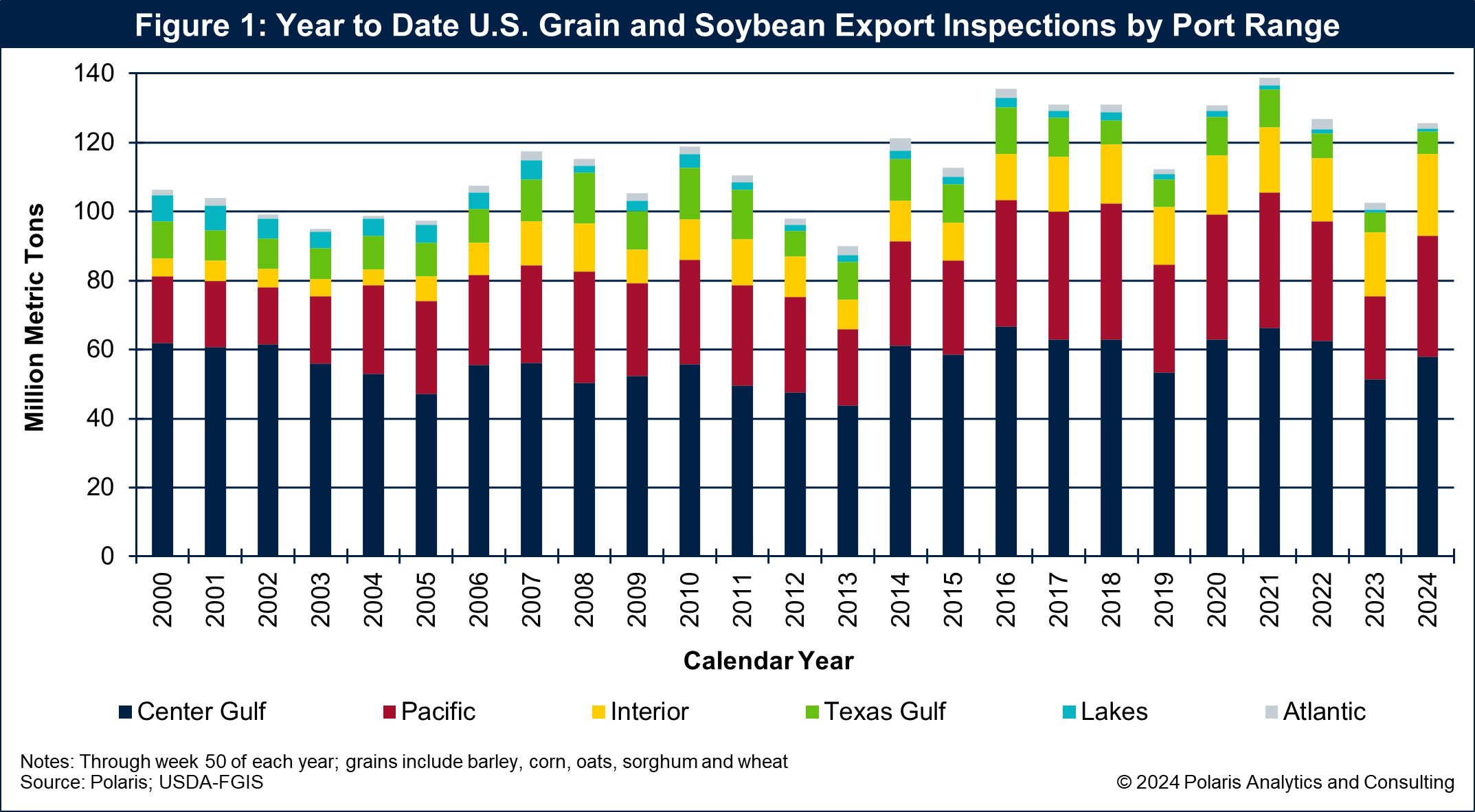

One item for the nice list is improved U.S. grain and soybean export inspections. Year-to-date exports through week 50, or December 12 for calendar year 2024, totaled 125.6 million metric tons. Exports were 22 percent above the volume for the same period last year while 2 percent above the average of the previous three years. This was the seventh time in U.S. history that exports exceeded 125 million metric tons, all since 2016.

Through grain export elevators in the Center Gulf, export inspections have totaled 58 million metric tons so far for 2024. The Center Gulf exports are 13 percent more than last year and 3 percent below the average for the past three years over the same period. More than 95 percent of the volume exported through elevators in the Center Gulf arrives by barge.

Elevators in the Pacific Northwest have fared better with a much-improved pace compared to their Center Gulf counterparts. Exports through PNW elevators have totaled 35.1 million metric tons so far this year, 45 percent more than the previous year and 7 percent above the average of the past three years.

Year-to-date U.S. grain and soybean export inspections through December 12 are shown in Figure 1.

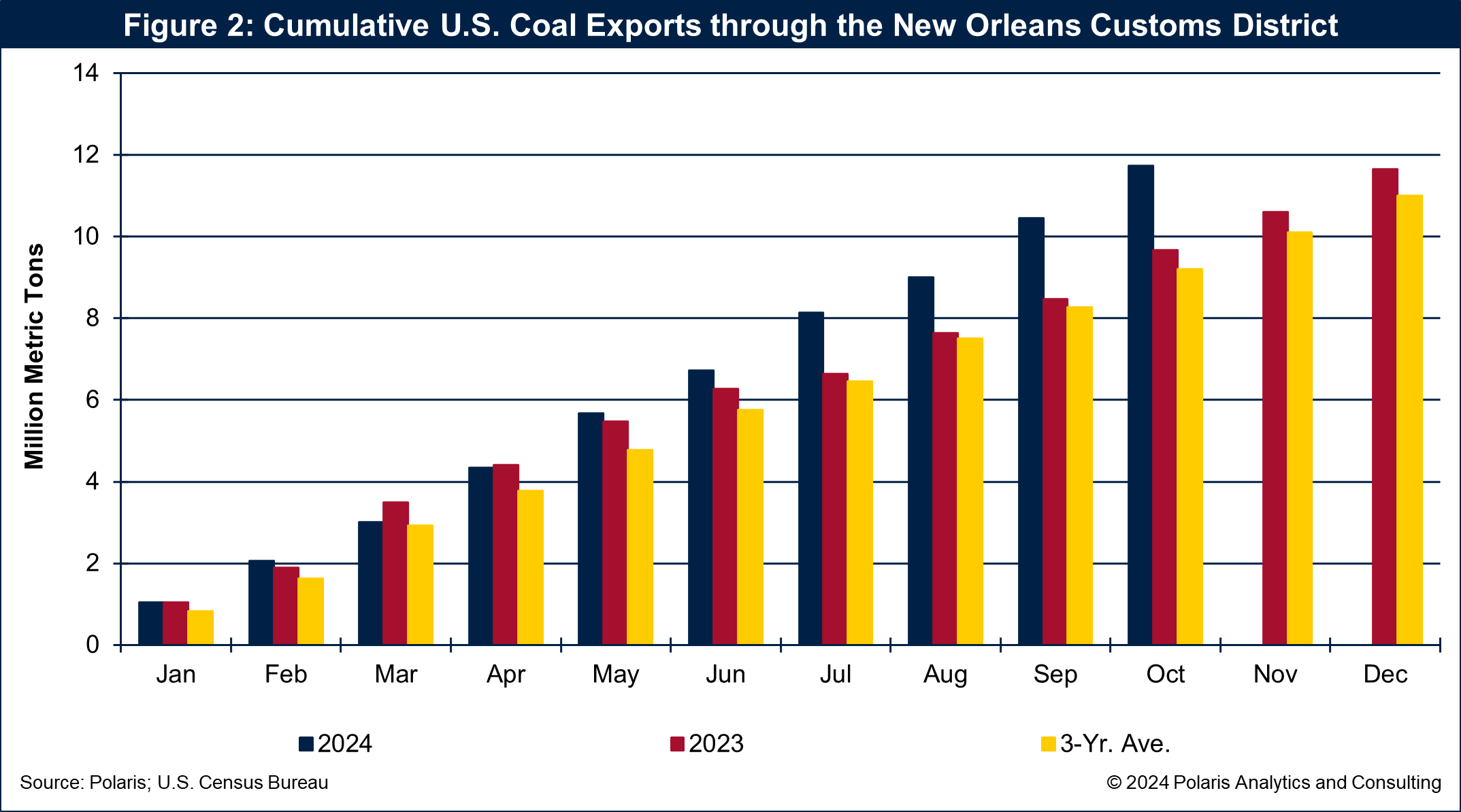

U.S. coal exports can be added to the nice list too. Through October 2024, the most current data available through the U.S. Census Bureau, coal exports have totaled 80.7 million metric tons for 2024. They are running 7 percent ahead of 2023 and 18 percent above the three-year average throughout the same period.

Recall that exports out of the Baltimore Customs District, which handles the second highest volume of U.S. coal exports, were non-existent until the Corps and Coast Guard opened a navigation channel following the collapse of the Francis Key Scott bridge. The bridge collapsed into and blocked the navigation channels from the allision of the mv. Dali.

Coal exports through the Center Gulf or New Orleans Customs District for 2024 totaled 11.7 million metric tons through October. Those exports are running 21 percent ahead of the 2023 pace and 28 percent above the three-year average.

Coal exports through the New Orleans Customs district are shown in Figure 2.

Water Levels: Not So Nice, Not So Naughty

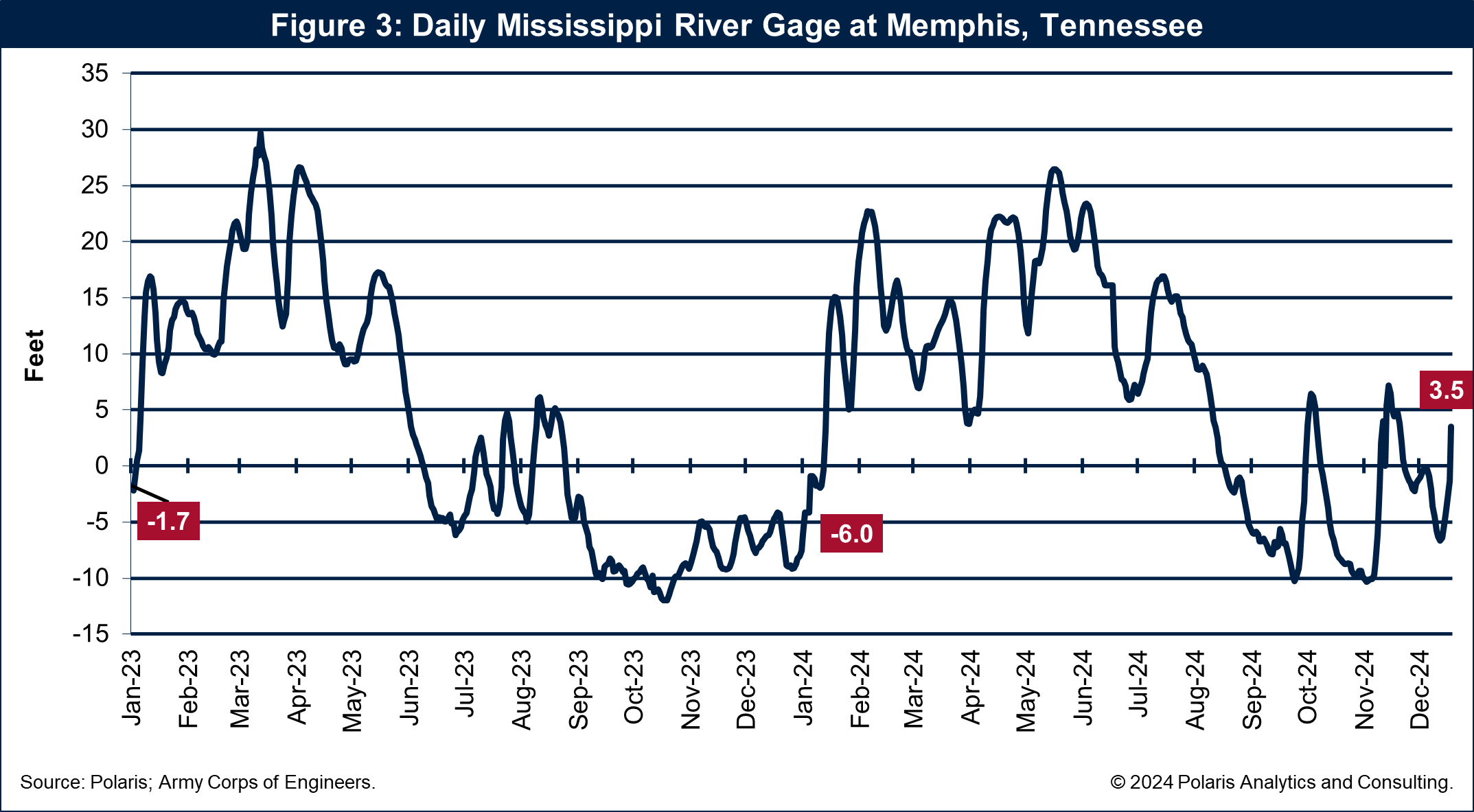

Water levels across the MRT have been on most people’s naughty list for the past three years. In fact, the fear is that low water has become a numbing experience, leading people to be complacent. However, collaborating with the Army Corps of Engineers and Coast Guard, the industry is anything but complacent, striving to keep the channels navigable even during extreme low water conditions.

The Mississippi River gage on the Lower Mississippi River at Memphis started 2024 at -6.0 feet, which was the lowest reading since 2000 when it was -8.5 feet. It has averaged 5.6 feet for the previous three years.

Despite the poor start, as of December 19, the gage reading was 3.5 feet while one year ago it was -4.3 feet and averaged 5.2 feet the previous three years. So, it is a bit naughty, but nice from where water levels have been of late.

The daily Mississippi River gage reading at Memphis is shown in Figure 3.

Barge Freight Rates: Both Naughty And Nice

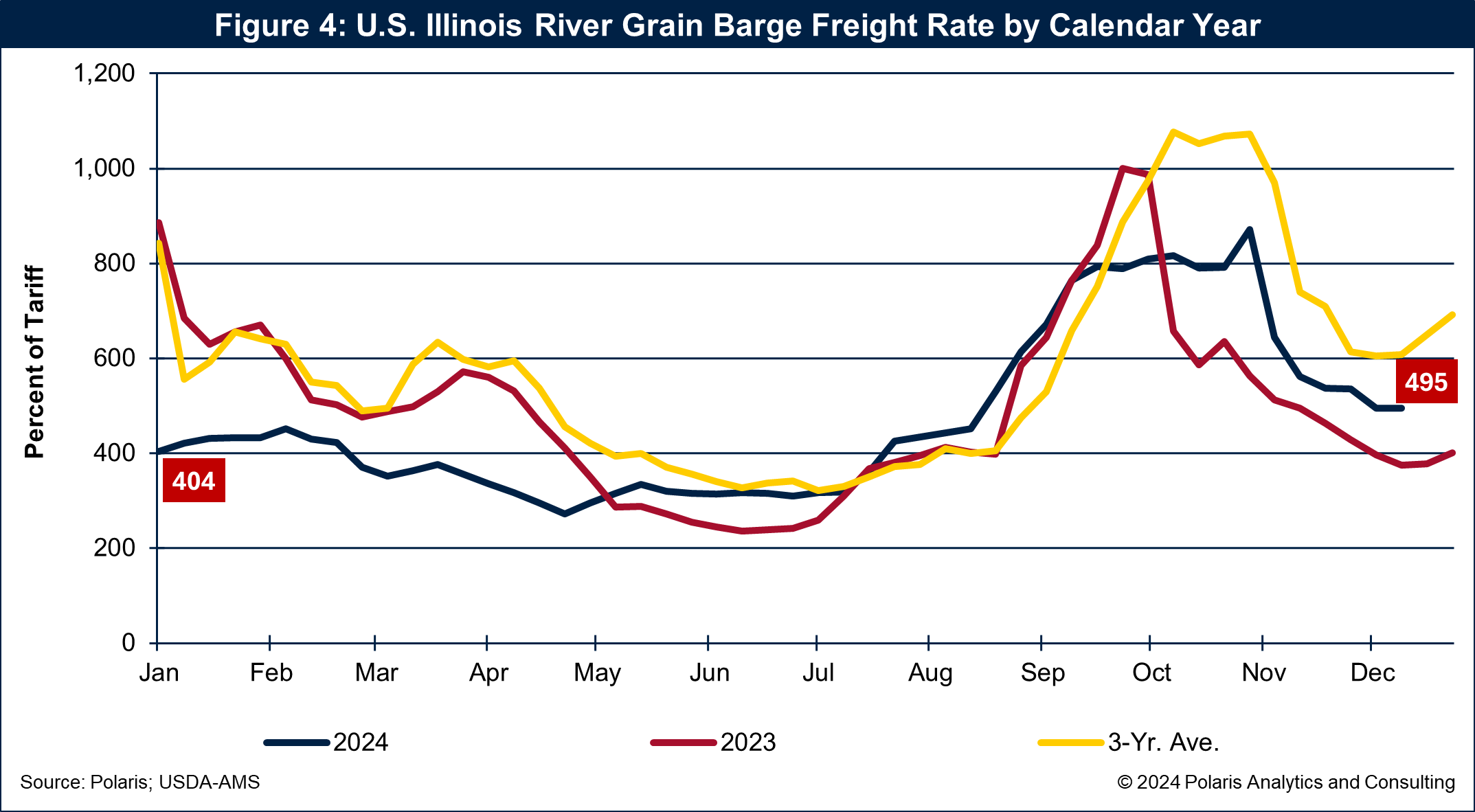

Depending on who you are, a shipper or barge operator will decide which list barge freight rates are on. To make the good list, shippers want lower freight rates while barge operators want higher rates. However, and this should be obvious, without freight costs being covered, barge operators struggle. With extraordinarily high barge freight rates shippers look for options.

Barge freight rates started 2024 at 404 percent of tariff off the Illinois River, more than half the level that the rate was in 2023 and the average of the previous three years.

Through December 10, or week 50 of 2024, the Illinois River barge freight rate was 495 percent of tariff, 23 percent above where it started in 2024 and 32 percent above the rate one year ago, yet 19 percent below the three-year average for this week. Despite a third consecutive year of low water conditions, the barge freight rate did not spike as in previous years.

Unlike this year, the extraordinary rate levels in the past three years have been associated with low water.

The barge freight rate off the Illinois River is shown in Figure 4.

Lumps Of Coal, Grain And Other Commodities Bring Good Tidings To Key Locks

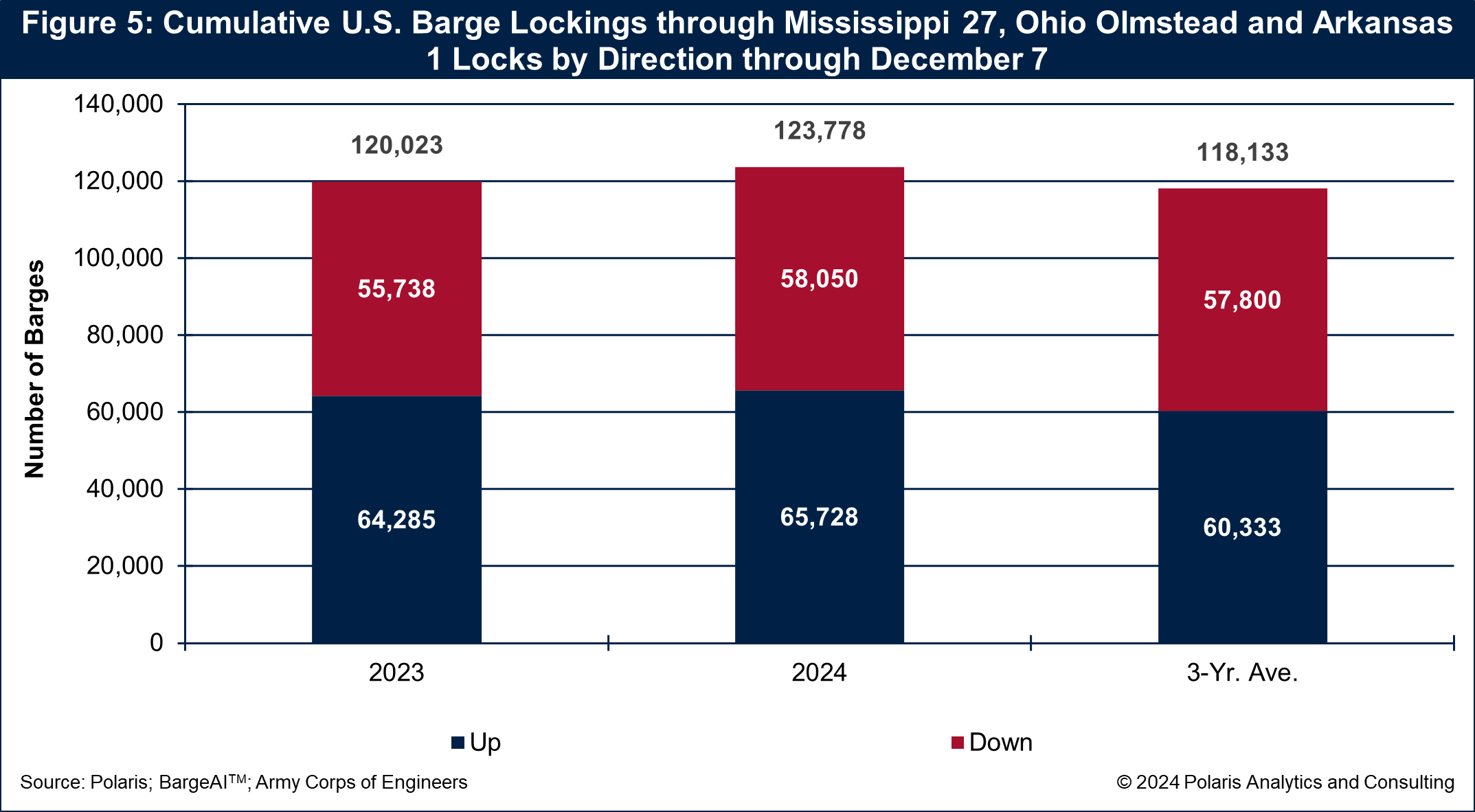

With the uptick in coal, grain and soybean exports, barge lockings of empty and loaded barges through key locks during 2024 has been filling barge stockings compared to 2023 and the three-year average. Based on data compiled by BargeAI of Action Intel, barge lockings through December 7 totaled 123,778. These lockings are an increase of 3 percent from 2023 through the same period and 5 percent more than the three-year average.

During any given year, nearly 70 percent of the barge lockings are loaded with cargo while 30 percent are empty.

The key locks are the first or last on to or off of the locking portions of the Mississippi, Ohio and Arkansas Rivers, including Mississippi Lock 27, Olmstead on the Ohio and the first lock on the Arkansas. While these lockings do not account for the entirety of the MRT, including the Lower Mississippi River, Gulf Intracoastal Canal and other such tributaries, the data is the most current available as compared to other Corps data for the rest of the MRT.

Cumulative U.S. barge lockings through the key locks are shown in Figure 5.

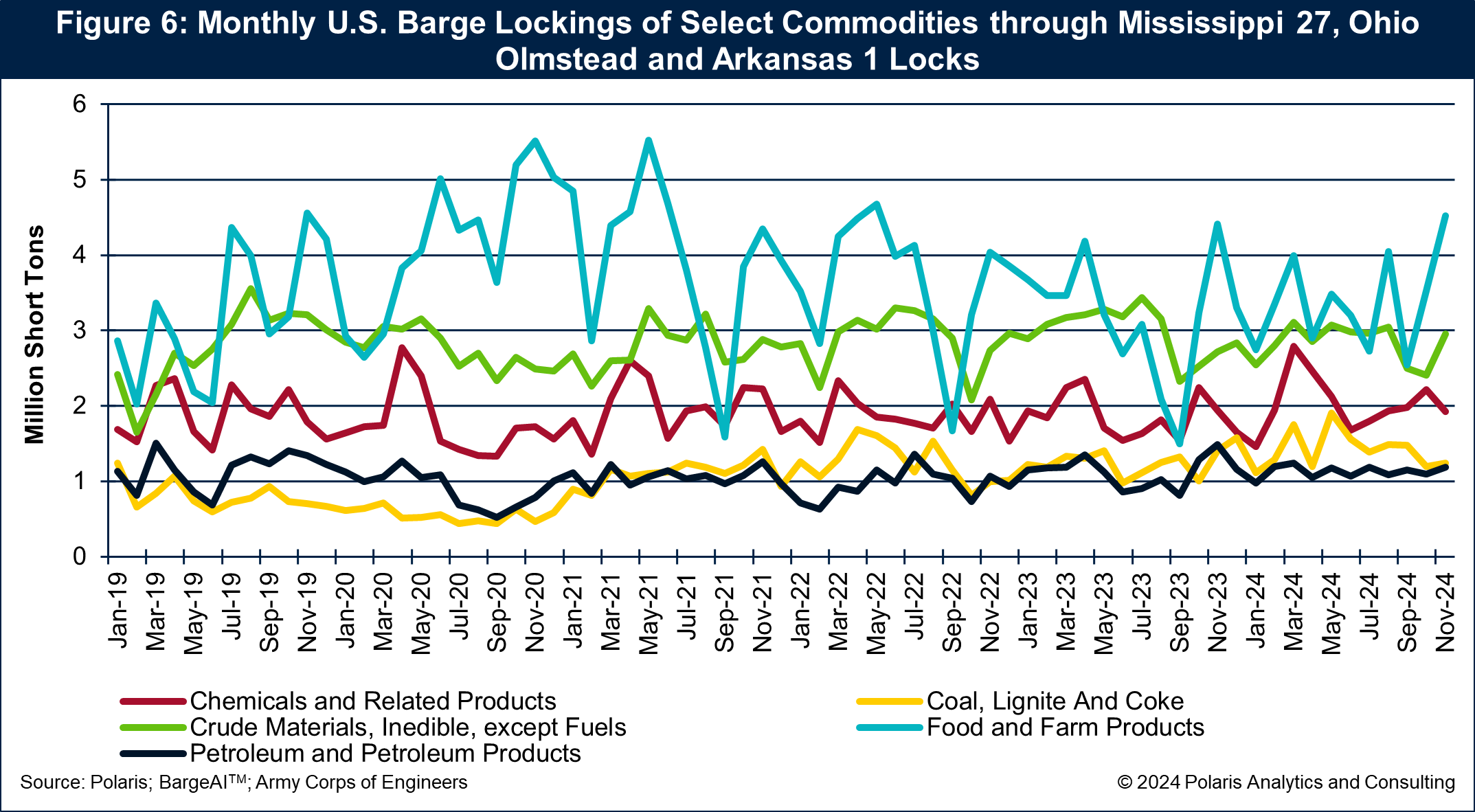

As much as total lockings are improved, so is the tonnage being moved by barge through the key locks. Total tonnage through November has totaled 132.5 million short tons, 3 percent more than 2023 through the period and nearly 2 percent above average. Coal lockings are up 15 percent through November as compared to 2023, totaling 15.6 million short tons. Farm and food products are up 6 percent at 37 million short tons and chemicals and related products are up 7 percent to 22.3 million short tons. Crude materials (inedible, except fuel) are down 5 percent to 31.2 million short tons.

Monthly barge lockings of select commodities through the key locks are shown in Figure 6.

Christmas Comes Early To The Mississippi River And Tributaries

As with any year, multiple factors influence commodity movements on the MRT. For 2024 some of the factors include low water that impacted navigation conditions on the MRT, low water through the Panama Canal that limited vessel transits and loading out of the Lower Mississippi River, competitive pressure against U.S. grains and soybeans, higher operating costs, persistent labor challenges, inflation that impacts consumer spending and capital investment decisions to name a few.

Despite those challenges, Christmas has come early for those depending on and using the MRT in the form of improved exports and barge movements, at least compared to the past three years.

May the hope and joy of Christmas fill your stockings, err barges!