Temperatures are warming up, daffodils are blooming, farmers are wanting to plant crops, river levels have been surging and falling and barge freight rates are stagnant. Spring is in the air. As much as spring is in the air, so is uncertainty with tariffs on, tariffs off, one moment to the next.

A review of current navigation conditions, the grain and soybean export pace and barge lockings will help kick-off spring with a view of what is on the horizon.

Like Clock Work, River Gage Readings Rebound

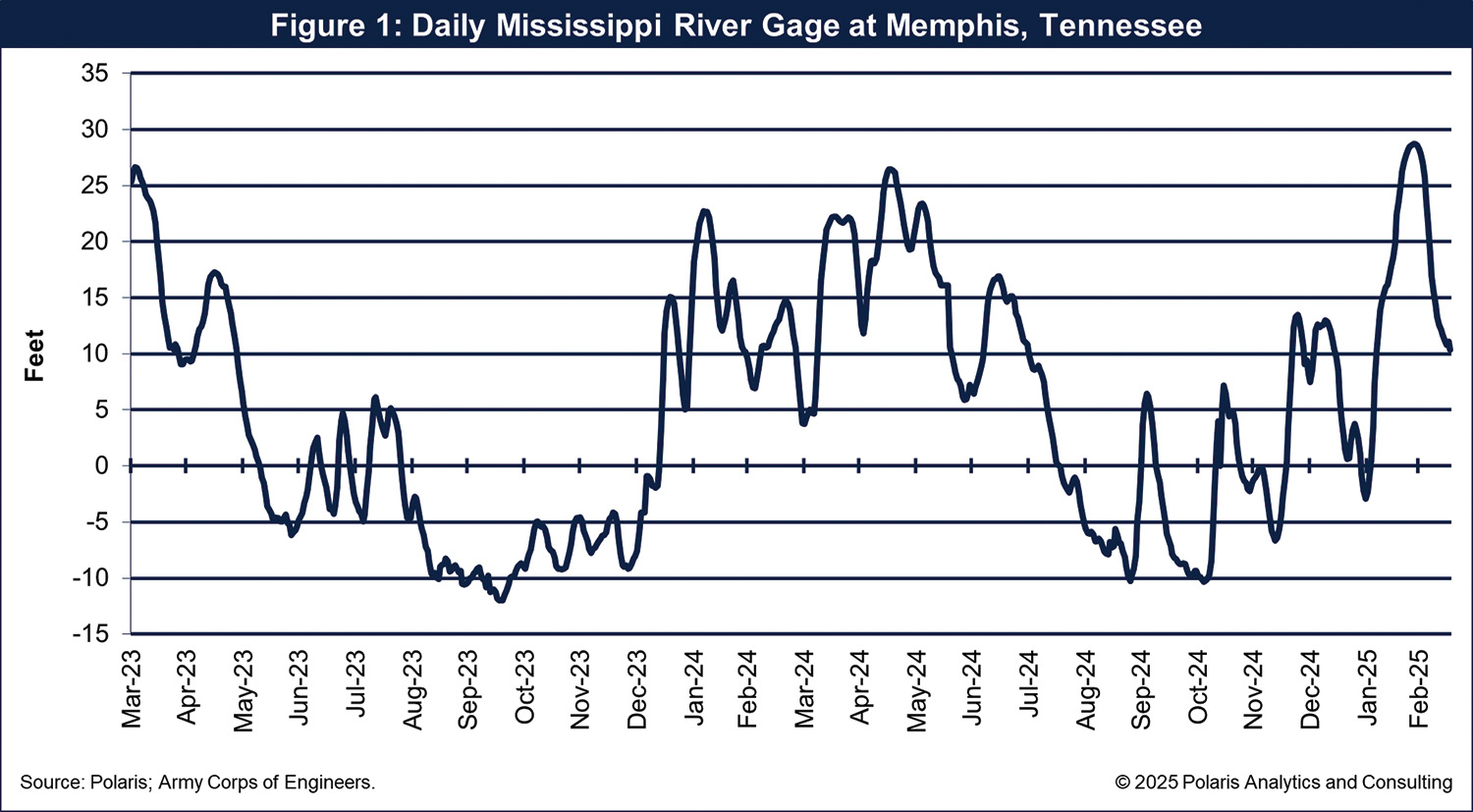

With most of the snow across the Mississippi River Basin having melted and timely rain events across Ohio, Tennessee and Mississippi River valleys arriving, water levels at various river locations have rebounded. At Memphis, the Mississippi River gage surged from a negative gage in early January to nearly 30 feet on the last day of February. Since then, the river level has retreated to less than 11 feet through March 17, putting it well below a 22-foot average for this day. The last time the Memphis gage reading was this low on March 17 was 2002. Over the past week, rain has fallen across the Southern river valleys and should provide further supplies across the basins.

Low water levels across the river system have been a problem the past three years. Working together, the barge operators, shippers and the Army Corps of Engineers and Coast Guard have developed relationships and procedures to mitigate the impact that low water events can have on navigation. The same can be said for high-water events that generally occur during the spring months.

The daily river gage at Memphis is shown in Figure 1 below.

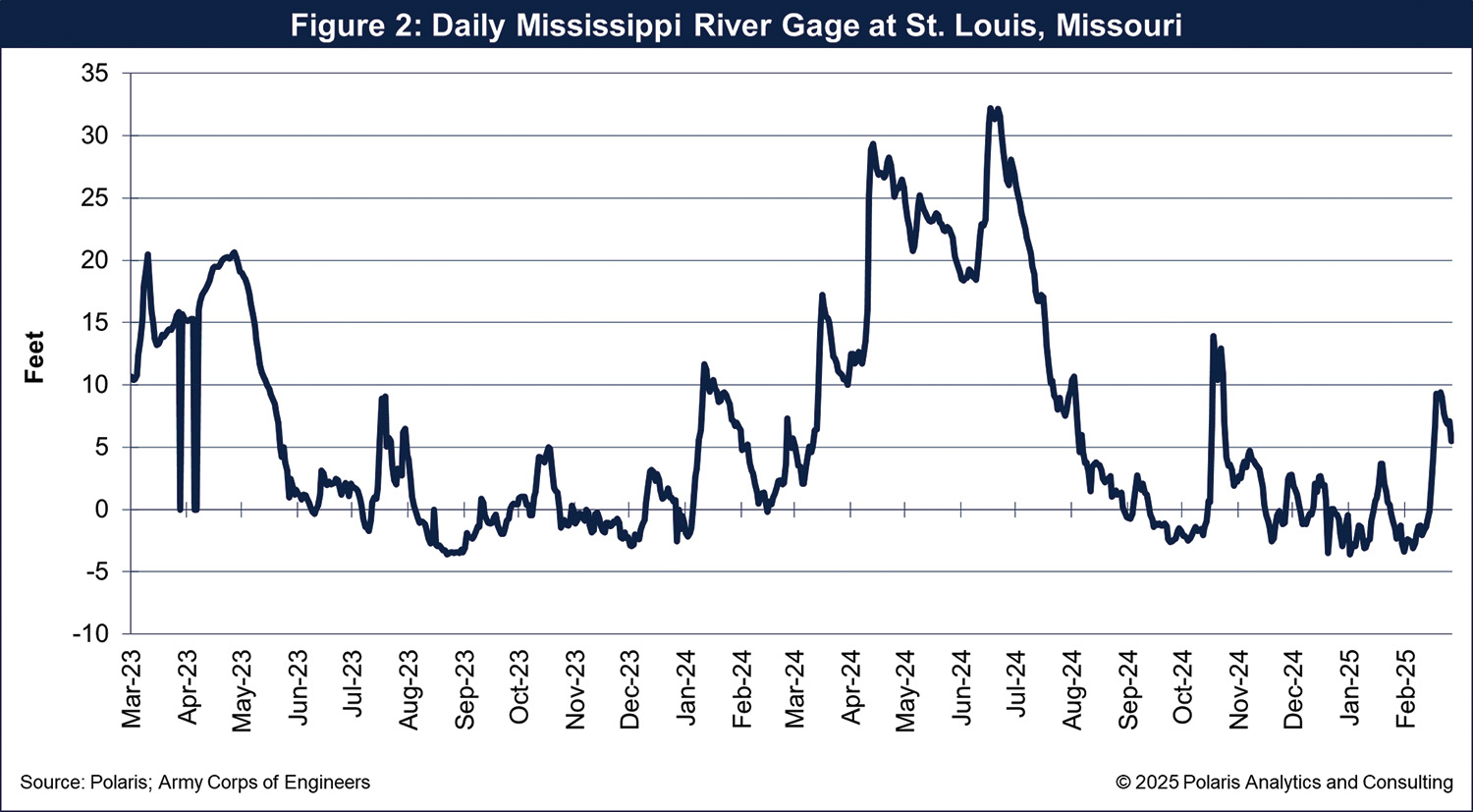

The Mississippi River gage at St. Louis has had a similar pattern to the Memphis gage, rising from -3.1 feet in late February to more than 9 feet on March 9. It has since receded to nearly 5 feet as of March 17. This gage benefits from the snowmelt along the tributaries of the Upper Mississippi River, especially from the Missouri River, and from seasonal rains. The Mississippi River gage at St. Louis is shown in Figure 2 below.

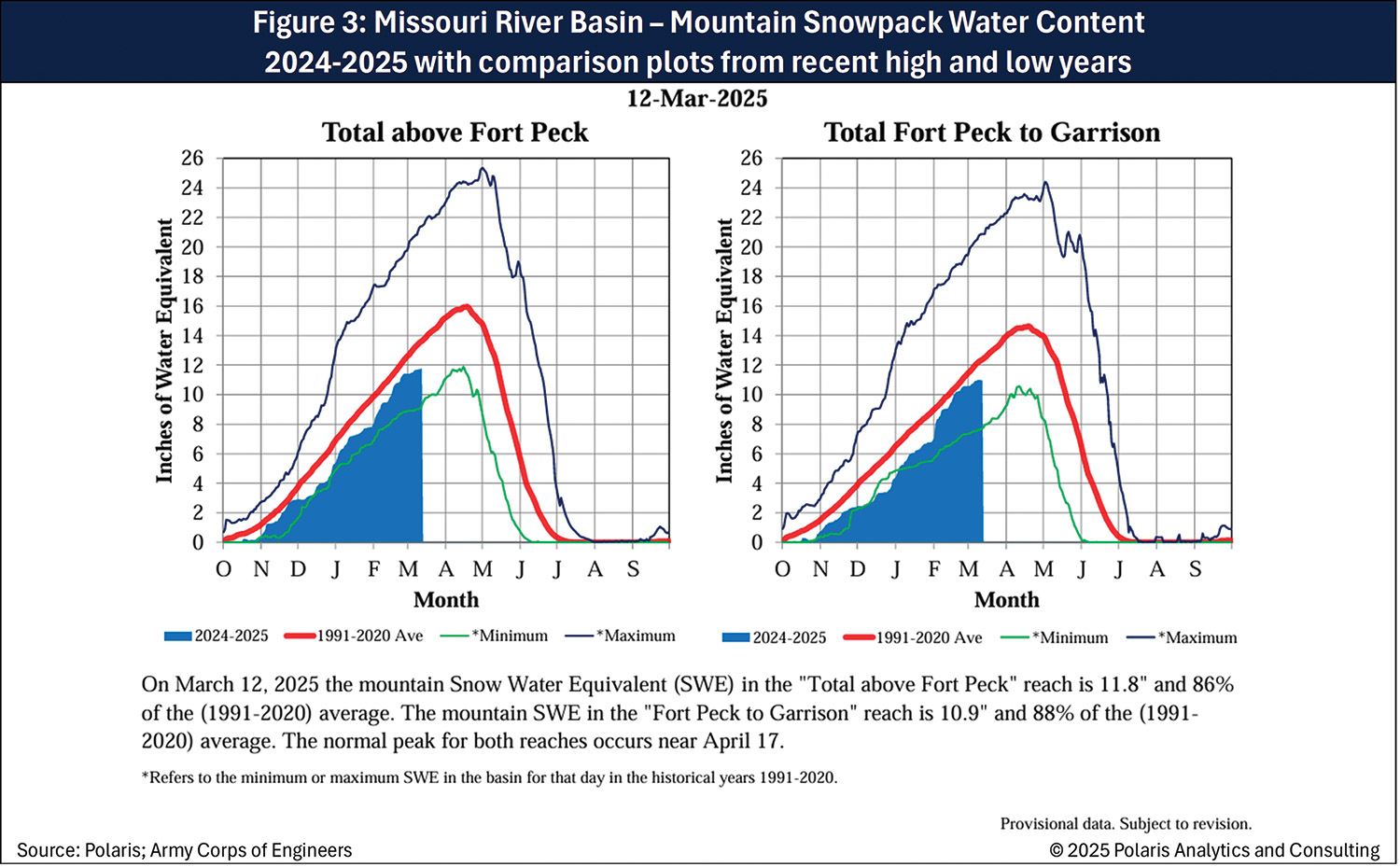

However, the Missouri River Basin mountain snowpack of 2023-2024 had less than ideal water content last fall and this winter. The amount of water content in a snowpack greatly impacts the amount of water in storage across the Missouri River Basin. Generally, a lower water content leads to lower water levels through St. Louis during the following fall and winter, and this year has been a testimony to that.

This year’s snowpack is slightly better, but 86 percent below average for this time of year. The snowpack generally peaks about mid-April as shown and discussed in Figure 3 below. Without much snow in the forecast, the snowpack water content could be as good as it will be. With below average water content, low water levels through the Mississippi River gage at St. Louis could be in the forecast this coming fall and next winter.

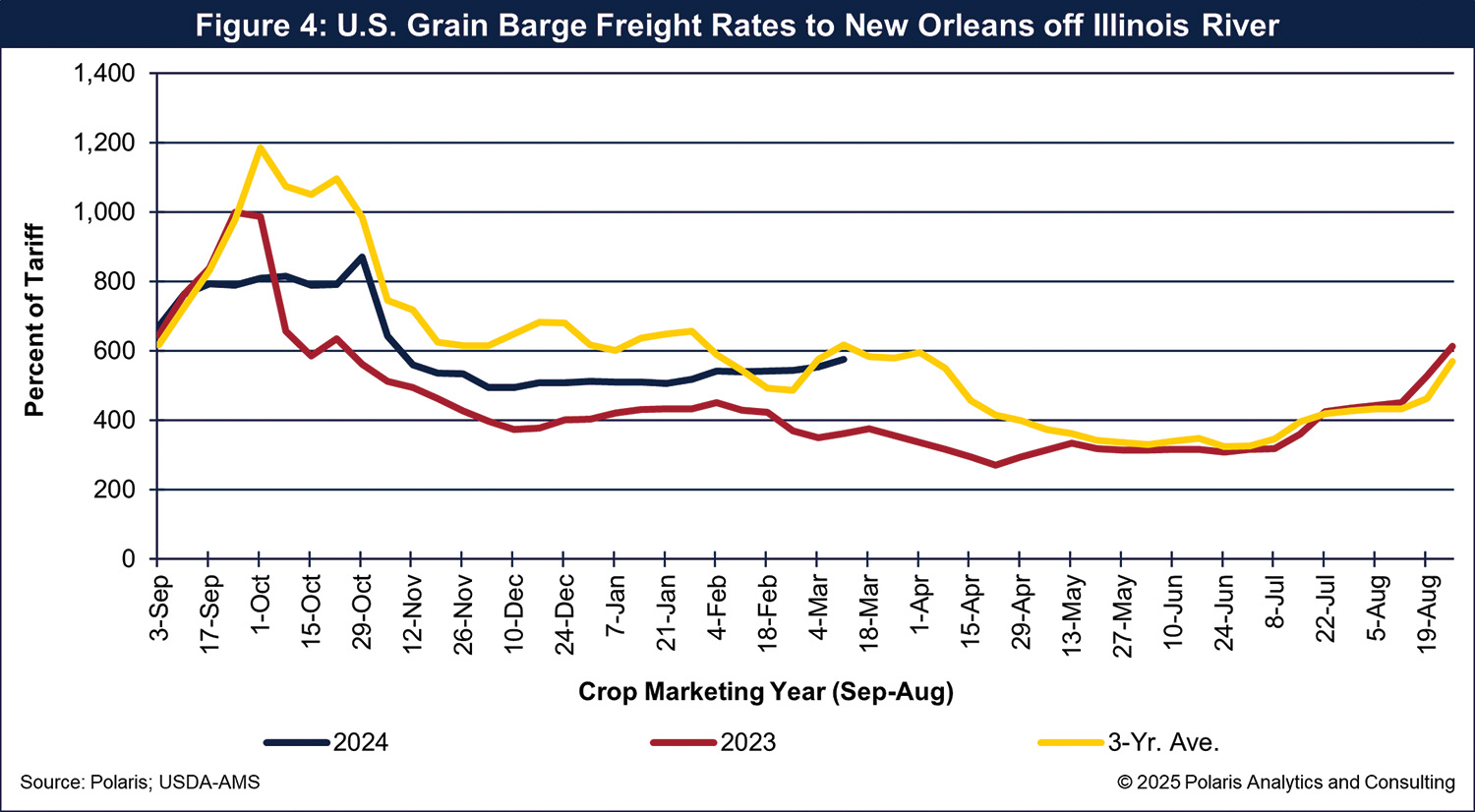

Barge Rates Essentially Flatlined Since Mid-November

Despite low-water conditions and surges in export volume, barge freight rates moving grain to New Orleans for export have been relatively stable since November. Since mid-November, the Illinois River grain barge freight rate has averaged 528 percent of tariff, from a low of 506 percent on January 21 to a recent high of 577 percent on March 11. The current rate is 40 points below average for this time of year, when it typically peaks as the Upper Mississippi River resumes operations from the winter, directing equipment to the reopened stretches.

However, compared to one year ago, the Illinois River barge freight rate is 59 percent higher. Rates generally fall to below 400 percent of tariff during the summer, bottoming in early July, as shown in Figure 4 below.

Grain And Soybean Barge Lockings Near Marketing Year Lows

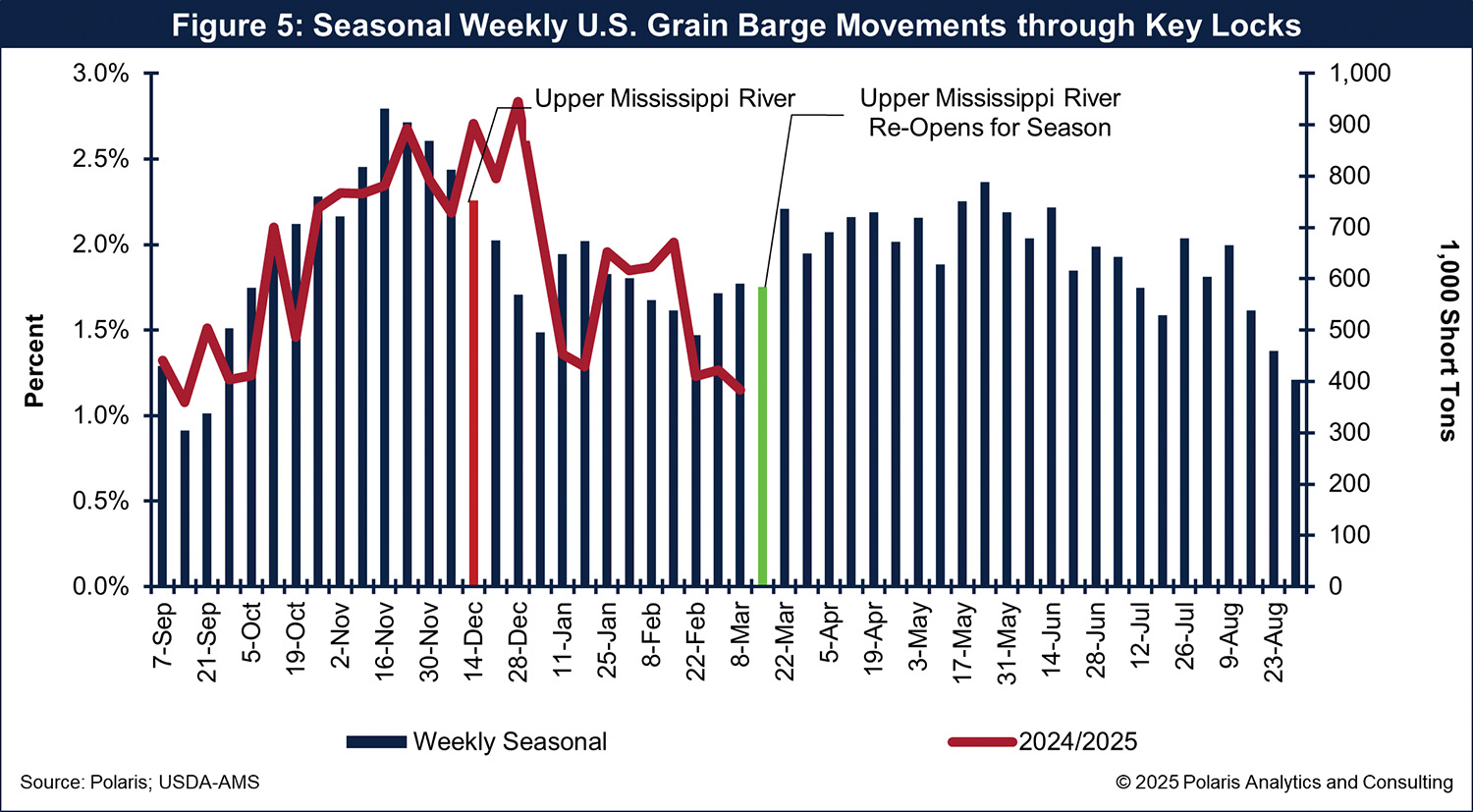

The movement of grain and soybeans by barge through the key locks on the Mississippi River System has dropped considerably in the past three weeks. During late January and through most of February, the movement of grain and soybeans through the key locks was well above average. However, since February 15, the volume has dropped like a rock, from more than 600,000 tons per week for four weeks, to about 400,000 the past three weeks as reflected in Figure 5 below.

While it is not uncommon for barge lockings to soften this time of year, especially ahead of the Upper Mississippi River resuming navigation, it is more than likely that movements supporting expedited exports prior to threatened tariffs were put into place by the Trump administration and retaliatory action by the impacted countries such as China and Mexico, two key customers of U.S. grains and soybeans.

Grain and soybean export inspections through elevators on the Lower Mississippi River have been fluctuating around the average of about 1.3 million metric tons the previous four weeks. In the most recent week ending March 13, export inspections totaled 1.4 million metric tons, slightly above the five-year average, reflecting the arrival of the increased locking volumes through mid-February. Weekly grain and soybean export inspections off the Mississippi River are shown in Figure 6.

U.S. grain and soybean exports for the 2024-25 crop marketing year that started on September 1, 2024, are forecast to total nearly 140 million metric tons. If realized, this would be a three-year high and the fifth largest export program in U.S. history.

Grain and soybean exports still have more to come. Based on export sales to date for the crop marketing year that started on September 1, 2024, outstanding sales (still to be exported) of corn total more than 20.8 million metric tons, nearly 3 million metric tons or more than 16 percent ahead of last year’s pace. Outstanding exports sales of soybeans total 6.5 million metric tons, about 1.6 million or 32 percent more than one year ago.

Export elevators along the Mississippi River handle between 50 percent and 60 percent of the U.S. exports each year. More than 95 percent of the exports through those elevators arrive by barge.

In Conclusion

Grain barge freight rates paint unique pictures of the barge market. On one hand, with rates relatively flat, operators and shippers have done well to manage through another year of low-water conditions while keeping improved exports moving to elevators on the Lower Mississippi River.

On the other hand, could it be that there are more barges in the fleet such that new barges entered service during 2024 and early into 2025 and retirements have been slow? The answer to that question will be understood in due time, when The Waterways Journal releases the results of the annual survey of barges operated on the Mississippi River and tributaries over the next few weeks.