The year 2024 was a momentous one for the waterways industry. A long drought that reduced drafts and cargoes moderated—with a devastating hurricane helping to restore water levels at a key moment.

Ports and terminals received floods of federal money released from the Bipartisan Infrastructure Law, as well as from other federal and state infrastructure programs. At year’s end, the industry finally achieved a long-sought goal: a permanent split of federal lock and dam funding on a 75/25 percent federal general funding to Inland Waterways Trust Fund ratio, along with other major funding wins that were included in the Waterways Resources Development Act, recently reconciled between the House and Senate.

But as if to remind the industry not to get too excited about funding progress, a number of unscheduled lock closures disrupted river traffic as components operating far beyond their design life gave way. Heroic efforts by the Corps of Engineers and its contractors worked to repair and reopen the locks. The closures brought home once again the years of neglect of the country’s aging lock and dam system that will take more than a few funding cycles to reverse.

On the legal front, the Supreme Court made major rulings that curbed the power of federal agencies to interpret their own authorizing laws, permanently altering the legal landscape not just for the maritime industry, but for all entities regulated by federal agencies.

Labor actions disrupted freight movements and showed once again the interdependence of all modes on each other. A presidential election and a changed world trade environment brought the issue of tariff barriers to the fore.

An increased pace of vessel- and barge-building helped get the industry ready for an anticipated upswing in barge traffic after several years of reduced building due to high capital costs.

Lingering Drought, High Water Cut Loads

After a year of drought and draft restrictions, rains finally eased the low-water situation on the Lower Mississippi and its tributaries at the beginning of 2024, but the drought’s effects continued across the continent, with water tables not fully replenished. In February, the American Waterways Operators focused on low-water effects during its annual combined regions meeting.

In early April, the Upper Ohio River valley received intense rain resulting in Pittsburgh’s most extensive flooding since 2005, rendering 11 of the 23 Pittsburgh Engineer District’s facilities temporarily out of service. High water on the Ohio River caused 26 barges to break away, damaging marinas and docks. In May, high water on the Illinois River forced American Commercial Barge Line (ACBL) to cut tow sizes by 50 percent.

Low water on the Lower Mississippi River was somewhat relieved by heavy rains over the Midwest in June and July, along with water pulled in by the weakening remains of Hurricane Beryl, but dryness and low water returned in late summer. A shift to La Niña weather patterns in late autumn finally signaled the end of the prolonged drought.

New Vessel, Drydock Construction

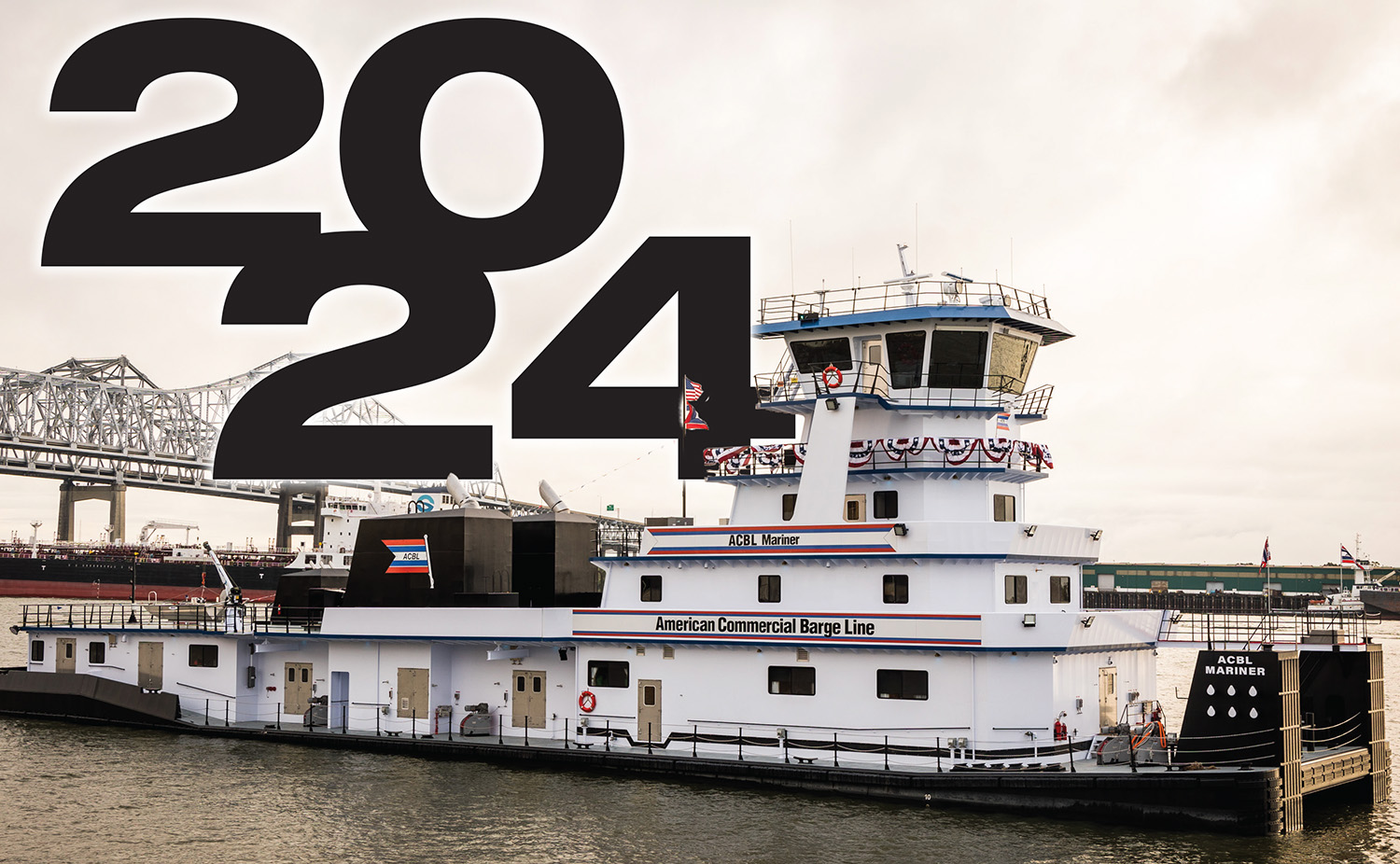

The year saw a number of noteworthy vessel construction projects. Tops for fanfare was the November 12 christening of the ACBL Mariner, the highest horsepower vessel built to operate on the Mississippi River since the 1970s. The christening ceremony included fireworks and a Mardi Gras-style parade.

Among the announcements of new vessel christenings came news of several new dredges and drydocks. The drydock construction was in response to a reported shortage of drydock space due to an uptick in the number of hull inspections pursuant to Subchapter M.

On February 20, Callan Marine of Galveston, Texas, christened the new 32-inch cutter suction dredge General Arnold, built by C&C Marine and Repair. In April, the Memphis Engineer District christened the drydock Manley, built by Conrad Shipyard, at Ensley Engineer Yard. That same month, Muddy Water Dredging LP christened its first vessel, the Vaneta Marie, a new cutter suction dredge. On October 25, Great Lakes Dredge & Dock christened the hopper dredge Galveston Island. A sister vessel is expected from Conrad Industries next year.

Also in April, Amogy—a pioneer in converting ammonia into hydrogen fuel for towboats—announced a contract with Hanwha Ocean to deploy a newbuild ammonia-powered commercial vessel. Pointing the way to a possible hydrogen-powered future, on September 23 Amogy announced that the NH3 Kraken, the world’s first carbon-free, ammonia-powered maritime vessel, successfully completed its maiden voyage.

On May 2, Illinois Marine Towing blessed a new drydock, the Atlas, in Lemont, Ill.

Among other notable announcements about new vessels, on May 8 United Launch Alliance announced a contract with Bollinger Shipyards and Bristol Harbor Group to build a transport ship for Vulcan rockets.

Antonio Carrillo, president and chief executive officer of Arcosa, told investors during a third-quarter earnings call on October 31 that he believes the “aging and under-invested” inland barge sector is poised for a major barge-building cycle. “We expect a multi-year building cycle given the age of the inland barge fleet,” Carillo said.

“The market is in a situation to replace older equipment while needing to expand for market opportunities,” he continued. “Steel prices have eased, and capital costs are becoming more supportive, but labor issues continue to be a concern.”

Acquisitions, Expansions

In an economic environment favorable to increased consolidation, several companies announced expansions and/or purchases of other companies during the year. In January, marine terminal operator Carrix announced that Ceres Terminals officially rebranded as SSA Marine, four months after its acquisition in September of last year.

In February, Ingram Barge Company announced the creation of a subsidiary, Ingram Infrastructure Group LLC, to provide material-handling and supply chain solutions, a sign of Ingram’s sizeable expansion. The announcement came after Ingram’s acquisition of Seacor Holding’s Inland River Transport Holdings LLC (SCF Marine).

On September 12, the Jefferson County (Mo.) Port Authority announced the purchase of Riverview Commerce Park terminal at the Port of Herculaneum, the port authority’s first publicly owned terminal facility.

Passenger Vessel Woes

In March, the Port of New Orleans announced near 1.2 million cruise passenger movements in 2023, signaling a comeback from the COVID-19 pandemic.

Not all passenger vessel companies weathered the COVID crisis equally. In February, American Queen Voyages (AQV) ceased operations, and its owner, Hornblower Group, filed for bankruptcy. In April, American Cruise Lines acquired four paddlewheelers that previously sailed for AQV—the American Queen, American Empress, American Countess and American Duchess—for a reported $6.3 million.

On May 14, American Cruise Lines announced the scrapping of the passenger vessels American Countess and American Duchess.

Hurricane Impacts

Despite a relatively quiet peak hurricane season, the Atlantic basin saw 18 named storms in 2024, with five hurricanes out of 11 strengthening to major hurricanes.

On July 8, Hurricane Beryl caused significant storm surge flooding across parts of Texas and Louisiana after making landfall near Matagorda, Texas, as a Category 1 storm.

On Sept. 26, Hurricane Helene made landfall in Florida as a Category 4 storm. Helene’s high winds and flooding killed more than 230 people as it cut a swath of destruction up through Georgia, Tennessee and the North Carolina, where its torrential rains caused unprecedented flooding and damage to a mountainous area in eastern Tennessee and western North Carolina thought to be beyond the reach of such storms.

Helene was one of the most destructive hurricanes in U.S. history, although its direct impacts to waterways infrastructure occurred only on Florida’s Gulf Coast. For Tennessee, Helene provided the worst flooding in its history, breaking records set in 1916. The Corps of Engineers diverted resources to stricken areas, along with the Federal Emergency Management Agency.

However, much of the water Helene dumped on the central Appalachians ultimately helped replenish the drought-stricken Ohio and Mississippi rivers, supplying a badly needed boost to water levels during harvest season.

Hurricane Milton, the second-most-destructive hurricane of the season, made landfall in Florida on October 9 as a Category 3 storm. It killed at least 24 people as it moved across the Florida peninsula and out over the Atlantic Ocean.

Unscheduled Lock Closures

In January, the Louisville Engineer District announced the closure of the Ohio Locks and Dam 53 Project, officially replacing Locks and Dams 52 and 53 with Olmsted Locks and Dam and bringing a long saga to an official close.

As if on cue, a number of aging locks suffered unscheduled closures during 2024. On January 26, a catastrophic failure occurred at Demopolis Lock, located just below where the Black Warrior River enters the Tombigbee River. The closure resulted from a concrete failure at the lock’s upper miter gate sill. Teams throughout the Mobile Engineer District worked around the clock to repair the lock, which reopened on May 16, exactly four months after the breach occurred. Shortly thereafter, the Mobile District closed Holt Lock due to movement in a lock chamber monolith. A temporary bulkhead was installed, and the lock reopened to navigation on October 2.

On February 22, the Mobile Engineer District closed the Thad Cochran Lock (formerly Amory Lock) after a bearing failure, the second unplanned lock closure for the year. It was reopened after a brief closure.

On March 26, the Nashville Engineer District reported that the main chamber at Pickwick Locks and Dam, Tennessee River Mile 206, was closed to navigation due to “unexpected mechanical and electrical issues.” The main chamber experienced intermittent closures through May.

At the Columbia Lock and Dam on the Ouachita River in Louisiana, a “non-breach emergency” in August required adjustments to water levels to address structural concerns, temporarily affecting navigation. The Corps managed to adjust water levels without permanently closing the lock, so commercial navigation was not severely affected there. The pool above Columbia Lock and Dam was lowered by 3 feet, while the pool below the dam was raised by about 2 feet.

A more serious closure occurred at the main chamber at Wilson Lock and Dam on the Tennessee River, through which about 3,700 vessels and 11.4 million tons of commerce transit each year. On September 25, the chamber was closed after divers investigating popping noises discovered extensive cracks in both lower lock gates. The cracks were not present during a 2022 dewatering. The Nashville Engineer District (which operates the lock) and Tennessee Valley Authority (which owns it) recently concluded an examination that revealed more extensive damage to lock gates, including pintle castings and quoin blocks, than was initially suspected.

The Corps warned that “continuing operations with the gates in their current condition could result in a complete failure of the gate or further damage beyond repair.” The Corps later announced that April 2025 is the earliest that Wilson Lock could reopen.

Labor Issues

Two labor issues affected cargo movements across the continent during 2024. In August, Canadian rail workers walked off the job after the failure of contract talks between the Teamsters Canada Rail Conference, representing 10,000 engineers, conductors and dispatchers, and Canada’s two largest railroads, the Canadian National Railway Company and Canadian Pacific Kansas City.

After at first refusing to intervene, the Canadian government changed its mind after the one-day strike disrupted freight movements across the continent and into the United States.

On December 9, the Canadian National Railway reached a tentative four-year agreement with another union, Unifor, representing 3,300 employees working in “mechanical, clerical and intermodal functions,” heading off another threatened strike.

Freight movements were once again disrupted in October, as 36 East Coast and Gulf Coast ports shut down when 45,000 members of the International Longshoremen’s Association walked off the job after negotiations over higher pay and protections against automation stalled between the union and the United States Maritime Alliance, or USMX, a group of terminal operators.

That strike ended after three days, when the maritime alliance agreed to raises of $4 an hour for union members on top of the current base pay of $39 an hour, an immediate raise of more than 10 percent. Members also will get additional $4-per-hour raises every year during the life of the six-year deal. That will raise pay by a total of $24 an hour during the life of the contract, or by 62 percent in total. However, the deal didn’t end union concerns about automation.

Dali Strikes Key Bridge In Baltimore

On March 26, the main spans and the three nearest northeast approach spans of the Francis Scott Key Bridge across the Patapsco River in the Baltimore area collapsed after the container ship Dali struck a bridge pier. Six members of a roadway crew were killed, while two more were rescued from the river. The ship remained stuck in the wreckage for almost two months.

The collapse blocked most shipping to and from the Port of Baltimore for 11 weeks. Maryland Gov. Wes Moore called the event a “global crisis” that affected more than 8,000 jobs, with the closure’s impact estimated at $15 million per day. The port reopened June 12. Moore joined Transportation Secretary Pete Buttigieg and White House officials to reopen the port following the reinstatement of the Fort McHenry Federal Channel.

An investigation by the National Transportation Safety Board determined that the Dali had lost power twice after leaving the port. In October, after a legal battle, the Dali’s owner, Grace Ocean Private Ltd., and its manager, Synergy Marine Group, both based in Singapore, agreed to pay $102 million in cleanup costs to settle a lawsuit brought by the Justice Department. Litigation over remaining costs is ongoing.

Safer Seas Act

One of the most impactful stories of 2024 for the maritime industry involved the Coast Guard’s and industry’s efforts to respond to the Safer Seas Act portion of the James M. Inhofe National Defense Authorization Act (NDAA) for FY2023. The act was passed in the wake of the Midshipman X incident in which a female cadet at the U.S. Merchant Marine Academy at Kings Point, N.Y., was assaulted while at sea during a semester at sea. Her story inspired several other female midshipmen to come forward with stories of their own and resulted in national headlines and intense calls for action.

During the spring meeting of the Greater New Orleans Barge Fleeting Association on April 9 through 11, a panel including maritime attorneys and the Coast’s Guard’s top enforcement officers laid out strict new reporting policies that had the support of top maritime officials, including Rear Admiral Ann Philips, administrator of the Maritime Administration.

Intense discussion centered on provisions requiring employers to report on incidents in their employees’ past, with no time limits and with severe financial penalties for non-compliance. The Coast Guard announced a policy of denying license renewals (considered an administrative penalty that can be applied at will) to individuals with certain incidents in their past, including those from long ago or for which sentences had already been served. The new Coast Guard reporting procedures require employers to report any newly discovered incident within 10 days, no matter how long ago it occurred, though some states prohibit employers from asking about prior convictions in a job interview.

SASH (sexual assault and harassment) reporting also took center stage at another maritime law event, the St. Louis Inland River Seminar, sponsored by Fox Smith, which was held September 16-17. Maggie Gentzen, a partner at Fox Smith, made clear there was no chance of the Safer Seas Act being repealed as some maritime interests have called for. There have been reports of several lawsuits over denials of licenses or other maritime credentials due to the new policies.

Important Court Rulings—Chevron Deference Overturned

The Safer Seas Act was not the only legal item with important impacts for the maritime industry. In February, the Supreme Court upheld “choice of law” provisions in marine insurance contracts under maritime law—the first marine insurance case decided by the Supreme Court in more than 50 years.

The Supreme Court made a number of other significant rulings over the summer, including one that “fundamentally changed the ways that laws are interpreted and enforced by federal agencies,” according to one commentator. The ruling in Loper Bright Enterprises v. Raimundo, which overturned a long-standing federal judicial doctrince known as “Chevron deference,” has been called the most important in a generation.

That doctrine—created not by Congress or statute but by an earlier Supreme Court in a 1984 decision involving Chevron—allowed federal agencies to determine the meaning of their own authorizing statutes in cases of disputed or ambiguous language. “Chevron deference” spawned an entire field of administrative law. Critics of Chevron deference long claimed the court had turned over Congress’s lawmaking power to unelected federal bureaucrats.

Chief Justice John Roberts wrote in Loper Bright, “Chevron is overruled. Courts must exercise their independent judgment in deciding whether an agency has acted within its statutory authority. … Careful attention to the judgment of the Executive Branch may help inform that inquiry … but courts need not, and under the APA may not, defer to an agency interpretation of the law simply because a statute is ambiguous.”

The ruling was cheered by those who believed the federal government had overreached during the past 40 years.

California Emissions Fight

The year saw back-and-forth news on the tug and barge industry’s fight with California over a rule imposed by the California Air Resources Board (CARB) that would impose diesel particulate filters on all commercial watercraft. The devices operate at very high temperatures, and the Coast Guard declared in a letter to CARB that it would not examine or certify marine engines with DPFs. The industry pointed out that no such devices exist for commercial harbor vessels, and the potential market is too small for manufacturers to develop them.

Seeking to mobilize public opinion, the American Waterways Operators, working with West Coast maritime groups and unions, helped persuade a near-unanimous bipartisan majority of lawmakers in the California Assembly to back a bill, AB1122, that would have offered important exemptions and extensions to CARB’s requirement. However, on September 29, California Gov. Gavin Newsom vetoed AB 1122 despite near-unanimous bipartisan support. The road ahead is not clear for harbor craft on California’s waters.

Funding Wins

The year was marked by a flood of federal funding for ports and waterways infrastructure. On December 14, 2023, Congress passed a National Defense Authorization Act that included a $1.35 billion dollar package to boost modernization opportunities for ports, maritime infrastructure and shipbuilding and expand workforce education and training. That helped kick off a year in which federal funding poured out to ports and waterways infrastructure.

On February 2, President Joe Biden announced $1.1 billion in “transformational” maritime infrastructure projects as part of his Investing in America agenda, awarding money to areas such as Humbolt County, Calif., and the Port of New Orleans.

Also in February, the Environmental Protection Agency (EPA) launched a $3 billion Clean Ports Program to fund zero-emission equipment and infrastructure, tackle the climate crisis and improve air quality at both coastal and inland ports.

In August, the Department of Homeland Security announced grants totaling $90 million to 200-plus applicants under the Port Security Grant Program for fiscal year 2024.

In September, the Federal Transit Administration awarded $300 million in grants, including to ferries in Illinois and Louisiana.

Altogether, in 2024 the U.S. Department of Transportation’s Port Infrastructure Development Program (PIDP) made a total of $577 million available for grants. This amount included $450 million appropriated under the Bipartisan Infrastructure Law, $50 million from the FY2024 Consolidated Appropriations Act and $88.4 million from reallocated funds from prior years.

Much of that funding was focused on the Gulf Coast. The Port of New Orleans received more than $530 million in total infrastructure funding, including $226 million from the INFRA (Infrastructure for Rebuilding America) grant program and $73.8 million from the MEGA (National Infrastructure Project Assistance) program.

On November 15, 31 projects across 15 states and one U.S. territory were awarded funding from this total pool to improve port capacity, efficiency and supply chain reliability. They included some large grants, such as one totaling $38.5 million for a soybean-handling facility in Hennepin, Ill., that will include a 700-foot dock and barge-loading equipment. The Landing Dock Safety and Efficiency Project in Chicago was also awarded $34.5 million to rehabilitate 3,000 feet of a dock wall, construct roughly three new heavy-lift crane pads and add approximately 1,700 feet of new rail spur at the Iroquois Landing Terminal.

While some American ports welcomed new or increased federal support, their overseas port competitors also were on the move. In November, Mexico announced a $3 billion expansion program over a 10-year period for the port of Manzanillo on the Pacific Coast. China is the main supplier of goods that move through the port. When complete, the project will quadruple the port’s capacity and make it one of the largest Latin American ports and among the top 20 container ports in the world.

Also in November, Chinese President Xi Jinping visited Peru to inaugurate the new, Chinese-financed port of Chancay, which significantly expands China’s presence and influence in South America and opens up a high-capacity trade route.

The year ended with a December “Christmas gift” for waterway advocates, with Congress finalizing the terms of the Water Resources Development Act (WRDA), including a permanent switch to 75 percent federal funding of lock and dam projects, with 25 percent to be provided by the Inland Waterways Trust Fund. The House passed WRDA on December 10, and the Senate was expected to quickly approve the legislation and the president sign it into law.

“This cost-share change allows for an estimated $1.4 billion of additional dollars over a 10-year period to be available for Energy & Water Development appropriations that fund the Corps of Engineers,” said Deb Calhoun, senior vice president of Waterways Council Inc. “Specifically, with annual IWTF revenues of $115 million, a 75/25 cost-share allows for $460 million in appropriations, an increase of $131 million above the 65/35 formula. This is a big win.”

The final WRDA 2024 included support for the Inland Waterways Regional Dredge Pilot Program; safeguards and written notice around any Corps decision to operate locks remotely; and support for the Gulf Intracoastal Waterways Brazoria and Matagorda Counties Project for $322,761,000.