A smooth Election Day and the election of Donald Trump to a second term as president, along with his pro-business policies, has led to a renewed confidence in the economy. The expectation of reduced or favorable taxes, removal of burdensome regulations and bureaucracy, enhanced manufacturing opportunities and secure borders, among other issues, has given investors much to appreciate, and markets have responded accordingly. While the promise to level the playing field with trading partners has concerns, the underlying goal is to have reciprocity with those partners.

Over the next 73 days, Trump will reveal his core team members and solidify his immediate plans once he takes office January 20. In the meantime, the state of Congress will be confirmed. The Republicans will control the next Senate, but the final count has not been tallied. Control of the House, as of November 7, is still too close to call. Regardless of which party controls the House, the majority will be slim.

Trio Of Events

Waterways stakeholders have a trio of events in the coming days. The 11th annual Waterways Symposium will be held in San Antonio, Texas, November 14. The symposium is hosted by Waterways Council Inc. and The Waterways Journal.

The annual International WorkBoat Show will be held November 12–14, and the Marine Finance Forum will be November 14, with both events in New Orleans.

For the most part, these events feature complementary programs and agendas. However, one underlying theme at all the events will be the election results and Trump returning to the White House.

I will be participating in the Waterways Symposium, speaking Thursday afternoon on the Economic Outlook: Global Supply Chain for Commodities Moving on the Inland Waterways. This column explores themes that will be featured at the coming events and that I will be addressing in San Antonio.

Eager To Break Out

Consumers across the United States and around the world have endured inflationary costs for necessities, while also spending or splurging on other goods and services. As highlighted in the May 3 Horizons column, consumers are spending more while getting less. This is what inflation does. It raises the price of goods and services while restricting the amount bought or used.

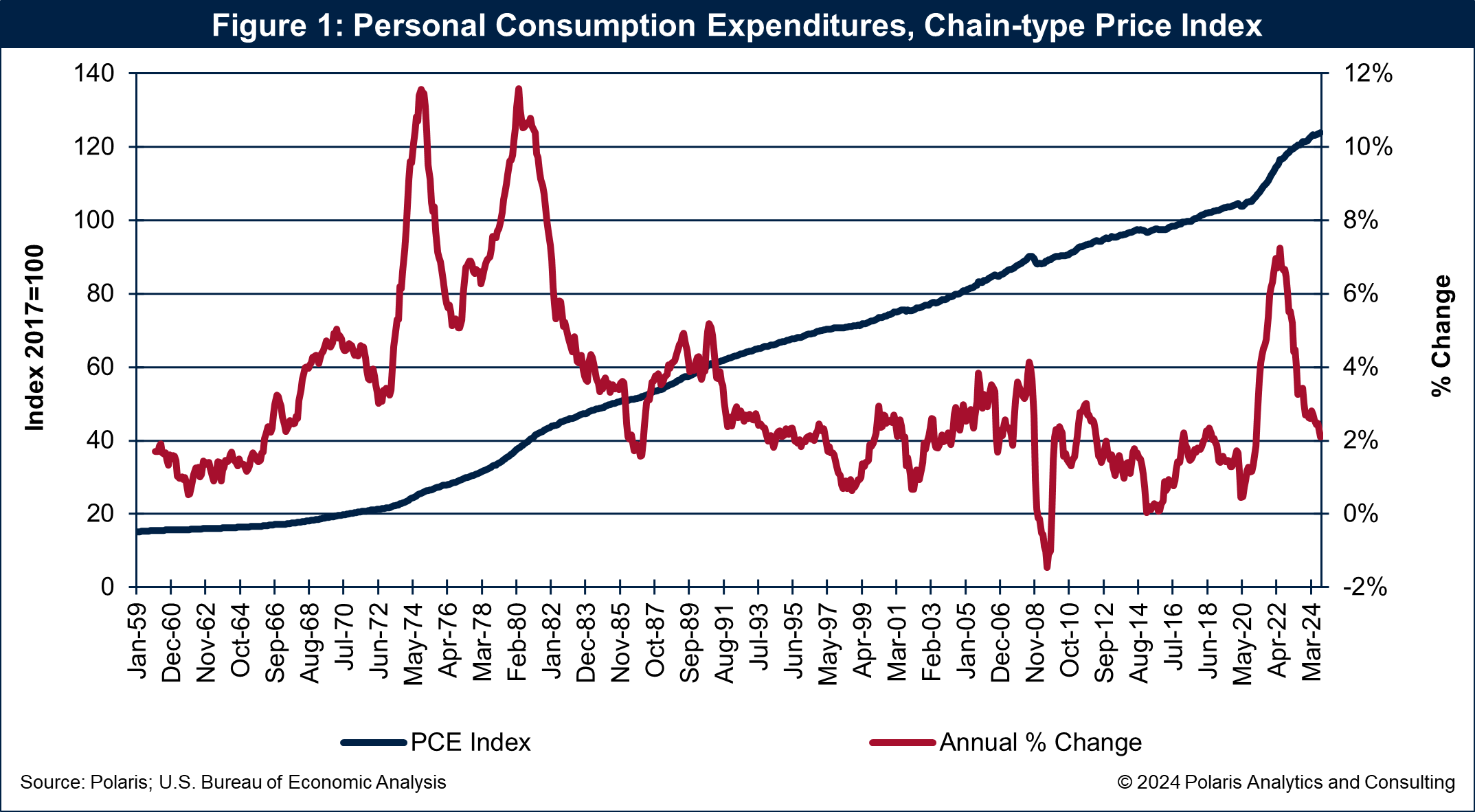

The Federal Reserve raised interest rates as an attempt to “cool” or slow the economy. The Fed’s favorite tool to monitor the strength of the consumer and economy is the Personal Consumer Expenditures index (PCE). The most recent PCE from September had an index of 123.9, which was 2.1 percent higher than the previous September and two-tenths of 1 percent higher than August. The PCE spiked to its recent peak of 7.2 percent year over year in June 2022. That peak was the highest level since 1982.

While the PCE is down from its peak, it remains positive and elevated above levels consumers were accustomed to from about 2012 through early 2020. The consumer became addicted to relatively low inflation and was often ignorant of its potential. Regardless, inflation set in and damaged consumer appetites and buying patterns.

The PCE index and percent change is shown in Figure 1.

Population Patterns

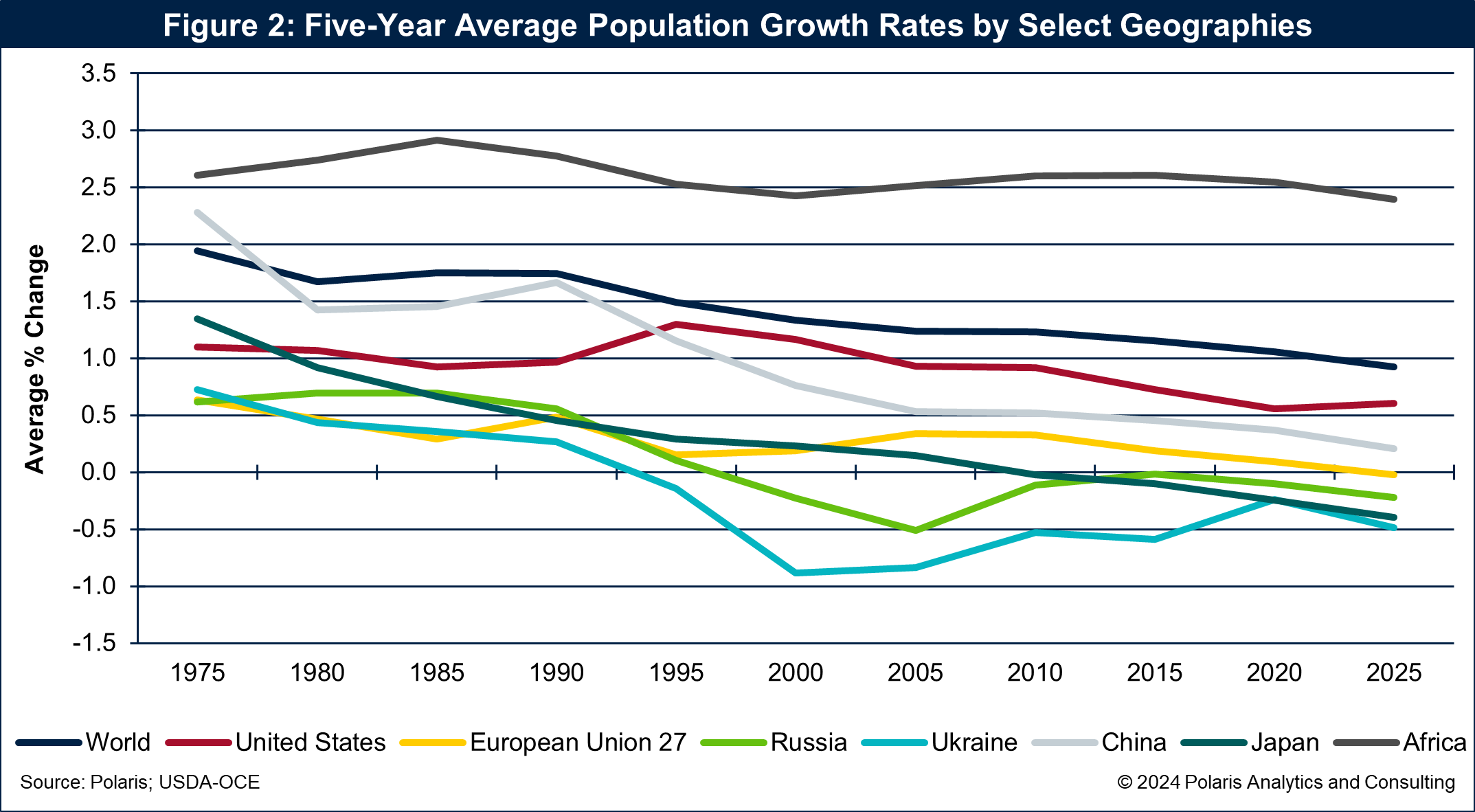

Population trends and patterns cannot be ignored. Economies can only thrive and survive with a healthy population. However, several economies around the world have falling population trends, and some are turning negative.

Globally, the average five-year population growth rate is expected to be less than 1 percent by next year, down from nearly 2 percent in the five years ending in 1975. As the calendar turned to the new millennium, the growth rate averaged 1.3 percent.

The five-year growth rate in the United States is expected to average 0.6 percent through 2025, down from 1.2 percent in 2000. The European Union 27’s five-year average population growth rate is already negative and will average -0.2 percent through 2025. Russia’s average growth rate turned negative in 2000, while Ukraine’s did so in 1995. With the ongoing war in Ukraine, population growth in those countries will remain negative.

When China instituted its one-child policy to slow population growth, that policy was successful, and its population declined at an accelerating pace. That policy, however, led to a negative growth rate, which will continue for the foreseeable future. Because China is a significant consumer of global commodities, its falling population will impact the United States, Brazil and other countries that send commodities there.

Without a robust population, a country does not have the vibrancy of a labor force to support its economy, let alone its aging members. Some countries, such as Russia, China and Japan, have incentivized couples to have babies to grow their populations. The challenge for these countries and others is that long-held policies have turned into cultural acceptance and reality. Having babies is often perceived as a burden. For those economies, population growth is a matter of national security.

There are few bright spots with solid population growth. The African continent and Philippines have growth rates that are sustaining and supportive, though life expectancy is an issue across Africa.

Population growth rates for select geographies are shown in Figure 2.

Other Economic Drivers

There are many other macroeconomic drivers to discuss, such as industrial production, unemployment, debt, currency rates, steel prices, ocean freight rates, barge fleet dynamics and much more.

These industry events are important to learn about market opportunities, hear of industry activity, engage with stakeholders and lobby groups and spend time together face-to-face with old and new friends alike.