Land Sales Flow Throughout Ohio River Corridor

By Bryce Custer, SIOR, CCIM

NAI Spring Commercial Real Estate

Logistics pricing and supply chain challenges due to COVID have increased awareness of shipping materials by the inland waterways and the Ohio River corridor. At NAI Spring we are seeing costs of riverfront property increase dependent upon existing infrastructure as supply (usable riverfront land) is purchased for manufacturing and intermodal operations.

The Ohio River from Cincinnati to Pittsburgh (including the Allegheny, Monongahela, and Kanawha rivers) is undergoing significant change from the coal power and steel manufacturing past to a petrochemical and plastics future. Abundant natural gas from the Utica and Marcellus shale area combined with Shell Polymers investment in plastics production in Monaca, Pa., have significantly improved awareness of the viability of the inland waterways system to reach 70 percent of the North American manufacturers within a 700-mile radius.

The other phenomenon we are experiencing is the small, private, second- and third-generation terminal operator considering retirement. In many cases, the next generation has little or no desire to continue the legacy of the family port/terminal. We are seeing sales to other private individuals and have had considerable interest from national terminal operators as they contemplate expanding their footprint to include inland brown water facilities.

Mark Twain said, “Buy land. They’re not making it anymore.” Navigable riverfront land is even scarcer.

For the past five years we have been involved with numerous sales of riverfront property with rail, barge cells and warehouse/manufacturing facilities. Riverfront prices have ranged from a low of $10,000/acre to a high of $200,000+/acre.

As is the case with most real estate sales, location, location and location are the three critical elements to valuation. As we value riverfront property, the No. 1 value consideration is of course existing cells or seawall, existing rail and access to highway.

Recent Notable Transactions

Notable Ohio River 2021 transactions include:

• ~38 acres (level/buildable) with barge and rail(spurs) at Ohio River Mile 112L, $105,000/acre

• ~240 acres (not currently buildable) with rail Ohio River Mile 49L, $14,000/acre

Prior Transactions (2017 – 2020):

• ~290 acres $60,000/acre (rail/barge)

• ~200 acres $45,000/acre (rail/barge)

• ~6 acres $100,000/acre (barge)

• ~7 acres $83,000/acre (rail/barge)

• ~8 acres $175,000/acre (active bulk terminal) no rail

• ~12 acres (useable) $125,000/acre (active bulk terminal w/storage no rail)

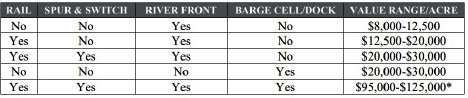

The following table provides a quick reference to property values throughout the Ohio and West Virginia area. These values are a general guide. Specific properties have inherent advantages and disadvantages which would be factored into valuation.

We anticipate greater activity in 2022 versus 2021 and prior years along the river. Regional, state and federal governments will continue to assist private companies in the cleanup and preparation of riverfront brownfield properties. Environmentally responsible manufacturing and decent wages for skilled labor and stevedoring port employment throughout the inland waterways will be key to future growth.

Companies throughout North America, Asia and Europe are looking for facilities along the inland waterways to circumvent logistical issues from major ports and to be close to their customer base.

Bryce Custer, SIOR, CCIM has been working with clients throughout the Ohio River corridor with sales/leasing of properties and terminal operations. Custer has been actively involved with site selection for natural gas power plants and manufacturing facilities throughout Ohio and West Virginia. Custer is a member of CORBA and NORBA and is on the Board of Directors for Shale Crescent. Custer is a licensed commercial real estate broker with NAI Spring in Ohio and West Virginia.